Democratisation reaches the VC industry

A top European VC firm opens it new fund to retail investors

Tweet of the week 🦉🏆

Individual access to venture capital is still largely restricted due to high minimum investment amounts and is usually the domain of institutional investors. This is unlike access to investing in startups which has been increasingly democratised through platforms like Angellist and crowdfunding platforms such as Seedrs and CrowdCube.

However this week marks the first mainstream crowdfunded venture fund in the UK with Passion Capital allocating £350,000 of its new £45m Fund III to not just HNW but also sophisticated investors on the Seedrs platform. This represents an exciting development for individuals to gain access to Passion Capital’s investing talent through investing in its new fund, which will be a diversified portfolio, rather than individuals investing directly in single startups via equity crowdfunding.

Passion Capital has invested in 81 tech companies to date including Monzo, GoCardless and Tide. It has invested in 11 startups so far in Fund III and plans to make an additional 15-20. If this trend was to catch on it would really democratise access to venture capital and increase the inflows into private companies.

If you enjoy reading this, please subscribe and share! 🙏

Funding 💸

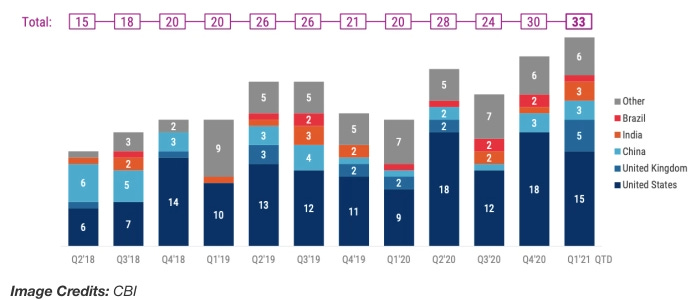

CB Insights reported the increase in “mega-rounds” of $100m+ in the fintech space over the last three years as evidence the sector is maturing.

There were 42 deals in the fintech space (now including crypto startups) across the US and Europe with total investment of $2.6bn. Some highlights are below.

🇪🇺 Elucidate has raised €2.5m in funding led by Frontline Ventures and included APEX Ventures and BiG Start Ventures.

🇪🇺 Moonfare, a platform that offers a range of private equity funds with €100k minimum investments, has raised a Series B from FISV.

🇬🇧 Zego has raised $150m at a $1.1bn valuation in a round led by @ Global and included Balderton, General Catalyst, Latitude Ventures and Taavet Hinrikus.

🙌🏻 FATP Take - Congrats to the Zego team for becoming the first UK insurtech unicorn!

🇬🇧 Wise founder Taavet Hinrikus and Teleport co-founder Sten Tamkivi are merging their angel investments into a new funding unit for their internal capital.

🇬🇧 UK based WorldRemit is considering a $1.5bn US SPAC in a knock to the UK’s financial markets which only recently proposed measures to boost UK listings.

🇬🇧 With news that Atom Bank was looking to raise £40m, it has been reported that it is at a 50% cut in valuation.

🇺🇸 Stripe has raised $600m at a $95bn private valuation from Ireland’s sovereign wealth fund, Allianz, Fidelity, Baillie Gifford, AXA and Sequoia.

🇺🇸 Pipe raised a $50m round from strategic investors including Next47, Raptor Group, Shopify, Slack, Chamath Palihapitiya, Marc Benioff and more.

🙌🏻 FATP Take - Check out Chamath’s 1 page thesis here

🇺🇸 M1 Finance has raised a $75m Series D in a round led by Coatue and included existing investors Clocktower Technology and Left Lane Capital.

🇺🇸 Wrapbook, a payroll provider for the entertainment industry, has raised a Series A led by Andreessen Horowitz and included Equal Ventures, Michael Ovitz and Uncork Capital.

🇺🇸 BlockFi has raised $350m at a $3bn valuation led by Bain Capital and included Paradigm, Parafi Capital, Raptor Group, Tiger Global and Valar Ventures.

🇺🇸 Belong raised a $40m round from Battery Ventures.

🇺🇸 ING is investing $3m into Flowcast, a startup focusing on helping banks make smarter credit decisions.

🇺🇸 Securonix has raised $24m from Capital One Ventures.

🇺🇸 Flywire has submitted its plans for an IPO to the SEC which could value it at $3bn.

🇺🇸 Vendr raised a $60m Series A led by Tiger Global and included Craft Ventures, F-Prime Capital, Sound Ventures and Y Combinator.

Challenger Banking 🚀

🇬🇧 Fintern has launched a low-value consumer lending product which bypasses credit scoring but focuses on affordability instead with a APR of 18.8%, lower than the UK average credit card (~23%).

🙌🏻 FATP Take - With underwriting advantages in credit scores hard to come by, there has been a shift in lending to focus more on cash flow based underwriting utilising income and spending behaviours, with data easily accessible through open banking.

🇬🇧 Habito has launched Habito One, a digital mortgage fixed for its entire term, with no exit fees or repayment charges and an application that takes minutes. Mortgages in the UK are typically fixed for between two to five years unlike their fixed for life counterparts in the US so this represents a significant shift in the mortgage industry.

🇺🇸 SoFi is buying community bank Golden Pacific for $22.3m to speed up its bank charter application.

🙌🏻 FATP Take - Assuming the acquisition goes through, this could pave the way for more acquisitions of small banks by fintechs to gain bank charters. However I feel this backdoor to a charter is unlikely to become mainstream and regulatory scrutiny of acquisitions will increase. I also think that banks also in their charters have to define their activities quite narrowly and any change in business strategy (post an acquisition for example) may need additional regulatory approval via a Change of Control application. This may still prove quicker than its new charter application. I am waiting for a tweet thread by @regulatorynerd on this acquisition :)

🇺🇸 Chime has already made $600m in stimulus payments available to 250,000 of its members, five days earlier than when traditional banks will make these payments available. For some this could be a crucial difference.

🇺🇸 Another vertical digital bank has launched this week, with Cheese focusing on the Asian community and promising $100,000 in donations to nonprofits and community programs.

Traditional Banking 🏦

🇪🇺 BNP Paribas is rolling out A2A for EU e-commerce merchants through its partnership with Token. Token has a single interface to 3,000 banks for the initiation of real-time account-to-account payments. What will be key is how they convince consumers to use it and change their entrenched payment behaviours.

🇬🇧 HSBC is building multi cloud infrastructure by partnering with Google Cloud for a new AI chatbot on top of its announcement last year that it was building a public cloud for its business operations with AWS.

🇬🇧 NatWest has shut its Esme Loans lending solution after three years. This is NatWest’s second fintech offering being closed as it shut challenger bank Bo last year. The UK bank will have to drastically rethink its fintech strategy.

🇺🇸 JPMorgan is finally killing off Chase Pay, its digital wallet payment method it inherited from Current-C, the failed retailer programme. The $100m invested into the product is all but a rounding error for the bank.

🇺🇸 Citi is streamlining its cross-border payments for institutional clients into a single electronic platform. This could be Citi revamping its payments UX across the company after learning a hard lesson from its poor internal UX that resulted in a $500m error payment to Revlon debt holders. American Banker also reported Citigroup is blocking the Revlon debt holders it incorrectly paid from new debt offerings.

Payments 💰

🇺🇸 Payments giant Stripe has listed two new roles for Product Managers, Buy-Now-Pay-Later on their career website tipping their hand that they are looking into offering a BNPL solution for merchants which could accelerate adoption.

🇺🇸 More Stripe news as it reported some interesting results from the onboarding of Postmates who saw $70m+ in added revenue through its use of Stripe Adaptive Acceptance due to a 2.16% higher authorisation rate over 12months and $3.3m in saved network fees. Shopify previously reported similar data and is also powered by Stripe.

🙌🏻 FATP Take - Apart from continued amazement at the superiority of Stripe’s product, the fact that it shares this data and the amount of revenue improvement from a customer is also really interesting. Ultimately a customer acquisition tool as well but its still rare to see this level of detail.

🇺🇸 Mastercard has completed the acquisition of a majority stake in Nets Corporate Services, a business account-to-account payment service for €2.9bn

🙌🏻 FATP Take - With card networks facing increasing competition from alternative payment methods, account-to-account payments stands to have one of the largest impacts on the use of cards, leaving Visa and Mastercard to try and keep themselves in the flow of payments. Mastercard has already acquired Vocalink in 2017 which powers the UK’s Faster Payments and now they are focusing on business payments with Nets. I recently attended the MIT Fintech Conference where Mastercard CEO Ajay Banga said “Mastercard is rails agnostic” giving an insight into their move beyond card payments.

Regulatory Corner 🔎

🇪🇺 The European Banking Authority had to take its email system offline this week after being hit by a cyber-attack.

🇺🇸 A group of fintechs have launched the Financial Technology Association (FTA) to educate and advocate for modernising financial regulations to advance innovation, inclusion and equity. Founding members include Wise, Afterpay, Betterment, Brex, Carta, Figure, Marqeta, Plaid, Quadpay, Ribbit Capital and Zest. H/T to Wise’s Nick Catino.

Longer reads 📜

The middleware game in open banking is over, now is the time for the application era - Aman Ghei

Why screen scraping still rules the roost on data connectivity - FinLedger

Inside Iconiq: How Mark Zuckerberg’s banker built a secret Silicon Valley empire and made billions - Business Insider

Banking’s long road to BaaS - Dharmesh Mistry, FinTech Futures

Is Revolut sitting on a £1bn crypto pile? - Daniel Lanyon, Altfi

The many paths fintechs are taking to banking’s mainstream - American Banker

Amex’s fraud detection AI was ready to go live. Then Covid hit - Hayden Field, Morning Brew

How the CFPB can better regulate data sharing - John Pitts, American Banker

Google: The Next Big Fintech Vendor - Ron Shevlin, Forbes

Your feedback is a 🎁, please give below 🙏

Good || Bad || Needs Improving

Follow me on LinkedIn and Twitter.

Michael