Is trust the achilles heel of blockchain?

Tweet of the week 🦉🏆

Very thought provoking tweet from Patrick about the news that Citigroup can’t claw back $500m from a fat finger $900m error payment (more below in regulatory corner).

Financial institutions operate in a market with many repeated games, within the game theory context. This means they will each consider the impact of their actions on the future actions of other players, which is why although they compete, there is generally high trust among FIs (although this clearly doesn’t extend to hedge funds!). This means operational mistakes between banks can usually be cleared up.

This got me thinking about how useful this trust based system is and my mind quickly shifted to DeFi and the blockchain. I am by no means an expert but in this instance on the blockchain, how would someone recover a payment made in error with, from my understanding, transactions on blockchains being largely irrevocable?

Currently if I make a payment via a bank to the wrong counterparty, I would at least have a fighting chance to reclaim the money back via the bank or legal means. But with crypto wallets increasingly anonymous, this may provide harder (or impossible) to do and hamper broader adoption, especially for large payments.

Very interested to hear differing thoughts on this so please reach out!

If you enjoy reading this, please subscribe and share! 🙏

Recent News 📰

🇬🇧 The UK is set to announce new visa’s for tech workers in a bid to boost the post-Brexit immigration system in welcome news for the UK’s fintech sector as it looks to maintain its position as a leading fintech hub.

Funding 💸

There were 47 deals in the fintech space across the US and Europe with total investment of $1bn. Some highlights are below.

🇪🇺 Swedish invoice payment company Billhop has a raised €4m Series A from Element Ventures.

🇪🇺 Swedish challenger bank Northmill Bank has raised $30m in a round led by M2 Asset Management and Coeli to expand geographically across Europe.

🇪🇺 B2B BNPL company Tillit is rumoured to be raising a €2.5m round from Sequoia and included investors LocalGlobe.

🇪🇺 OutSystems, a low code UX development company focused on fintech raised $150m at a $9.5bn valuation from Tiger Global and Abdiel Capital.

🇬🇧 Zego, the on-demand insurance platform for gig workers, is raising a $150m round from DST Global.

🇬🇧 After securing its full UK bank license, Cashplus is raising £50m to support its growth.

🇺🇸 Public.com has raised $220m investors including Tiger Global, Accel, Greycroft, Inspired Capital and Lakestar.

🇺🇸 Marqeta has filed confidentially with the SEC for an IPO with a valuation expected to be $10bn. Look out for teardowns of the S-1 soon!

🇺🇸 Stripe is rumoured to be raising money at a $115bn valuation, 3x its previous $36bn valuation.

🇺🇸 Titan raised a $12.5m Series A led by General Catalyst and included BoxGroup, YC, Instagram founder Mike Krieger and Aston Kutcher’s VC firm Sound Ventures.

🇺🇸 Citadel ID, founded by ex-Carta employee Kirill Klokov, raised $3.5m for its income/employment verification platform from Abstract Ventures and Soma Capital.

🇺🇸 SeedFi has raised $15m in equity, from a16z, Flourish Ventures and Core Innovation Capital, and $50m in debt to help Americans build up credit and savings.

🇺🇸 Varo Bank has raised $63m in a round led by NBA player Russell Westbrook who is working with the lender to create a social impact program.

🇺🇸 Kalshi, an exchange that lets users trade on the outcomes of real-world events, has raised a $30m Series A led by Sequoia and included Charles Schwab, Henry Kravis (of KKR fame) and YC.

🇺🇸 Carefull has raised $3.2m in a round led by Bessemer Ventures, K50 Ventures and angel investors for its financial caregiving platform.

Embedded Finance

🇪🇺 Norwegian Internet browser Opera is rolling out Dify in Spain, a browser cashback and digital wallet service for online shopping.

🇺🇸 Google Maps is now integrated with Passport and ParkMobile and public transport so users can pay for parking or train tickets within the Google Maps app.

Challenger Banking 🚀

🇬🇧 Monzo is asking the UK Government to mandate that banks implement a way for customers to block gambling payments in an initiative to combat the rise in online gambling during lockdown. Monzo has had this capability since 2018 and they are now working with TrueLayer to extend its block to open banking-enabled payments.

🇬🇧 Transferwise has shall hence forth be know just as “Wise” in a rebranding before its upcoming IPO. Not only an easier ticker to remember, the change also suggests it wants to be seen as more than an app for FX transfers as it seeks to build out a core banking suite.

🇬🇧 UK Challenger lender OakNorth is having to bear the weight of £97m in defaults from ten insolvent borrowers. Defaults make up just under 2% of loans issued but 2.77% of its outstanding loan book.

🇺🇸 Despite being busy preparing for its upcoming IPO, Marqeta has added credit cards to its issuing and processing platform, complementing its prepaid and debit card offerings.

🇺🇸 Brex has applied to the FDIC and UDFI for an industrial bank charter, to expand the products it can offer its card customers.

Traditional Banking 🏦

🇪🇺 Cash is still alive but the way we withdraw it could become contactless. In Switzerland a third of the ATMs are equipped with QR code readers and 20% have NFC readers according to SIX.

🇺🇸 Goldman Sachs has finally added Marcus Invest to its retail customers in the US, offering ETFs based on customers’ risk tolerances. It is a rather underwhelming product by all accounts and relies on the Goldman distribution machine for adoption rather than an innovative new product.

🇺🇸 Banks are fighting back against the trend of consumers using smartphones to pay bills directly with billers with the help of Mastercard Bill Pay Exchange. With new partners joining, Mastercard provides a platform for banks to offer a streamlined bill pay experience, helping them retain and engage more with bank apps.

SME Banking

🇬🇧 iwoca, a SME lender is integrating with SME accounting platform Xero, to provide SMEs with a Pay Later option for their business customers. A great example of embedded finance that is likely to become more pervasive.

🇬🇧 Revolut is enabling its SME merchants to offer QR code payments to consumers so they can scan and then pay, touch free, without any additional hardware.

Fintech Infrastructure 🚧

🇪🇺 Yolt has finally secured its own UK PSD2 licensing, reducing its reliance on ING’s own license.

🇬🇧 Capital markets fintech Origin Primary launched Airbrush, a universal data standard to optimise bond issuance. Airbrush will allow better communication and faster transfer of information between parties in a bond issue.

🙌🏻 FATP Take - Marc Rubinstein wrote about standardisation in his piece “The Business of Benchmarking” and their importance for industry growth. While the bond market already has some standardisation, in order for bond issuance to enter the digital and post-covid era, a universal data standard is needed to ensure data integrity. Origin is in prime position to facilitate this with its digital issuance platform and position in the ecosystem central to dealers, issuers, paying agents and exchanges. A nerdy piece of news for sure but interesting nonetheless 🤓.

🇬🇧 PensionBee is collaborating with PrimaryBid to give its customers access to its upcoming IPO, in an awesome move that should become more common by companies.

🇬🇧 Plaid has signed a deal with challenger bank Atom to power Atom’s business loan application and associated fee payment with its open banking and payments service and also includes future expansion into smart savings and lending solutions.

🇬🇧 Bud has signed ANZ NZ, New Zealand’s biggest bank, to improve its approval process for business loans through enriching statement data.

Payments 💰

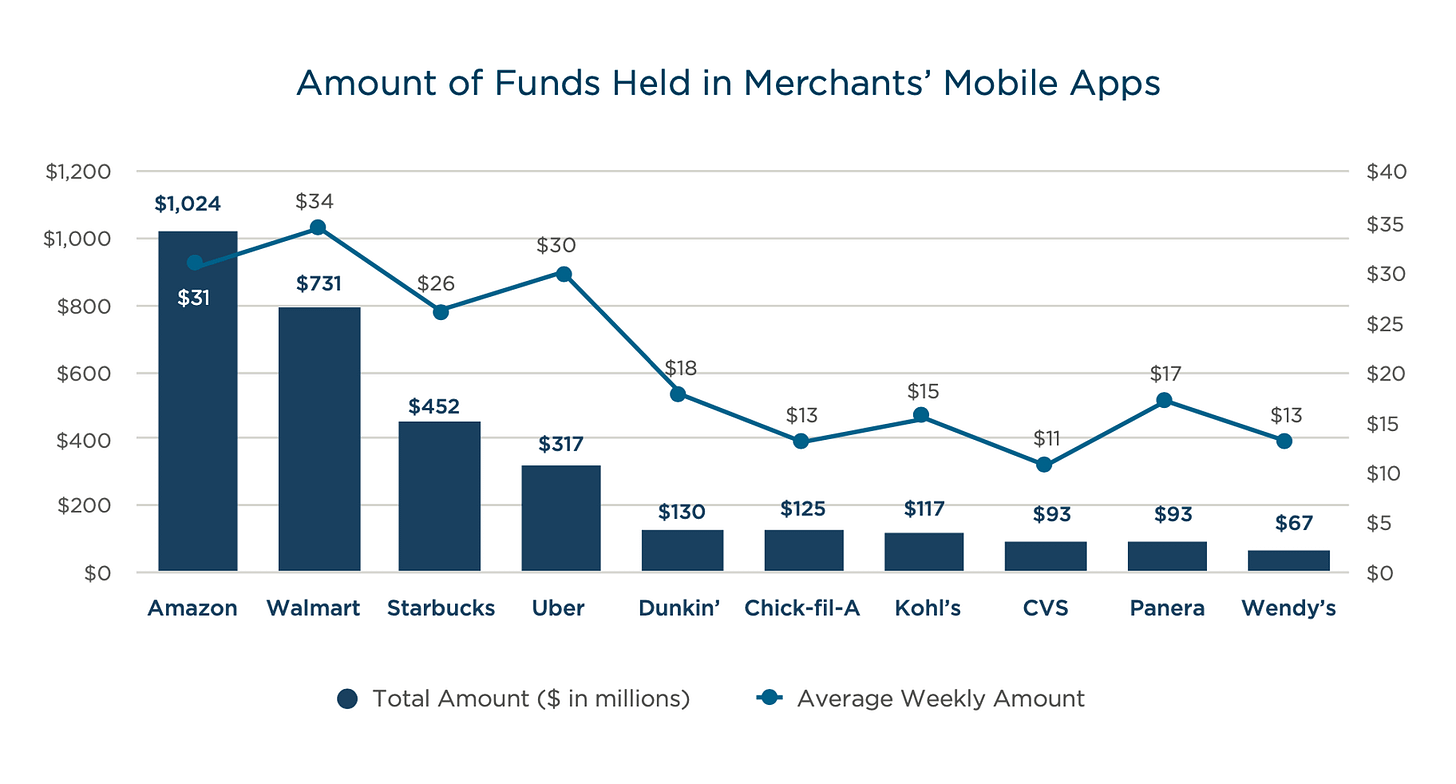

🇺🇸 Big tech companies and fintechs are cheating banks out of $250bn in payments volume according to data from Cornerstone Advisors.

🙌🏻 FATP Take - The largest displacement occurs because of merchant apps that consumers load with funds; with Starbucks, Amazon and Walmart being the most popular. Once consumers load funds onto merchant apps, the payments cost much less for the merchant, especially with high frequency low value purchases. The flat transaction fee really adds up on these types of transactions. h/t to Benjamin Jackson at Innovative Payments Associate for the explanation. With the rise of digital wallets like Apple Pay and Google Pay, consumers may be included to have more cards because they are easier to manage and carry than before and merchant specific offerings are likely to be popular.

Regulatory Corner 🔎

🇺🇸 Citigroup has lost its legal battle to recoup a large majority of an incorrect wire transfer it made last August. Citigroup mistakenly repaid the entirety of a $900m loan to Revlon’s debt holders, which wasn’t due in full until 2023, instead of just paying the interest due. The payment was made via a “clerical error” but much has been made of the apparent UX of the system used (above).

🙌🏻 FATP Take - Bloomberg’s Matt Levine covers the story with his usual flair here including the “six-eye review process” Citi has as well as Judge Jesse Furman’s assertion “To believe otherwise - to believe that Citibank, one of the most sophisticated financial institutions in the world, had made a mistake that had never happened before, to the tune of nearly $1 billion - would have been borderline irrational.”

🇺🇸 American Express received a subpoena from the US Attorney’s Office for the Eastern District (staffed by Oliver Dake in popular show Billions) in relation to its SME and consumer card sales practices and alleged “aggressive and misleading sales tactics”.

Longer reads 📜

The Policy Triangle - Marc Rubenstein, Net Interest

Breaking down the payment for order flow debate - Alex Rampell & Scott Kupor, a16z

Fixing insurance distribution: 3 schools of approach - Rob Moffat, Balderton Capital

The Case for Default Insurance - Angela Strange & Seema Amble, a16z

SWIFT gpi: The “Cutty Sark” of the payments world? - Currency Cloud

Economic Impact Payments - Dan Murphy, Financial Health Network

Why it would be a huge mistake to allow Big Tech firms to acquire banks - Fortune

Your feedback is a 🎁, please give below 🙏

Good || Bad || Needs Improving

Follow me on LinkedIn and Twitter.

Michael