#fintok

Tweet of the week 🦉🏆

The ICAS, a professional body for Chartered Accountants, recently reported on the increase in videos on TikTok which provide investment advice and tips in what might be a worrying trend for consumers. This phenomenon has increased following recent events such as GameStop, evidence by the rapid growth in views of #fintok videos to 235m views and #stocktok to over 836m views.

Anyone can upload a video on TikTok to give financial advice but there is likely to be increased scrutiny given the risks and lack of disclaimers for TikTok’ers giving financial advice, a highly regulated activity. Although TikTok has a disclaimer under the hashtags, individual videos themselves often don’t and they are unlikely to be sufficient to appease regulators. TikTok does however remove content that “deceives people to gain an unlawful financial advantage”. The FCA, during the throes of the GameStop saga, warned people of TikTok users “promising high-return investments”. Some #fintok videos can be educational, Rob Shields of @stock_genius shares knowledge on how to pay taxes and the history of the stock market via his videos. Rob has turned his 163k following into its own brand as he seeks to educate the younger users through his platform. On the flip side are accounts like @kriskrohn who recommends users forgo pension investing in lieu of real estate but was subject to a 2012 SEC complaint for fraudulently offering and selling real estate investments.

The FCA defines “advice” to mean “a recommendation of what you should do” which is a regulated activity, unlike “guidance” which is unregulated and defined as “information provided to help you identify options. It will not tell you what to do or which products to buy”. It is clear from these definitions that some of the videos on social media fall into advice and presents regulators with a new regulatory challenge. In 2015 the FCA published guidance on financial promotions in social media which these platforms should look into before regulators come knocking.

If you enjoy reading this, please subscribe and share! 🙏

Funding 💸

There were 45 deals in the fintech space across the US and Europe with total investment of ~$740bn. Some highlights are below.

🇪🇺 BitPanda raised $170m in a Series B led by Valar Ventures and included DST Global giving the company unicorn status, a first for Austria.

🇪🇺 Enfuce has raised €7m in a Series B led by Tencent and included existing investor Maki.vc.

🇪🇺 French fintech Pledg raised €80m from Aquiline Capital, Financiere Arbevel, Oddo BHF and Portag3 Venture.

🇪🇺 PayFit has raised €90m in Series D round led by Bpifrance and Eurazeo and included Accel and notorious angel investor Xavier Niel.

🇪🇺 Capdesk has raised a $11.15m Series A led by FISV and MiddleGame Ventures.

🇬🇧 Invstr has raised nearly $20m in a convertible Series A for its Robinhood competitor.

🇬🇧 Pollinate has raised a $50m Series C led by Insight Partners and included Mastercard, NatWest and Motive Partners.

🇬🇧 Diem has raised $5.5m in a seed deal led by hedge fund Fasanara Capital and included angel investors Chris Adelsbach and others.

🇬🇧 Sumup has raised €750m in debt from Bain Capital, Oaktree Capital, Crestline, Temasek and Goldman Sachs.

🇬🇧 Regional SME lender B-North has raised £4.45m from Estonian financial services firm LVH.

🇬🇧 Lumio has raised $1.6m in equity crowdfunding for its app targeting millennials and matches them with personalised financial products.

🇬🇧 Zopa raised $20m from its existing investors as it looks to expand from lending into savings.

🇬🇧 Ember has raised a £1.6m seed round led by Anthemis.

🇬🇧 Illuminate Financial has raised a new $100m fintech fund with investors including Barclays, JPMorgan, Deutsche Boerse and IHS Markit.

🇺🇸 Socure has raised $100m in a Series D valuing the company at $1.3bn which was led by Accel and included Citi Ventures, Commerce Ventures, Wells Fargo and others.

🇺🇸 NFT platform OpenSea raised a $23m Series A led by a16z and included Mark Cuban, Alexis Ohanian, Angellist co-founder Naval Ravikant and Ron Conway.

🇺🇸 FT Partners boss Steve McLaughlin has partnered with PE founder Gene Yoon to raise a $500m fintech SPAC.

🇺🇸 US challenger bank Chime is preparing for a $30bn IPO according to Reuters which would make it the 12th largest by market cap.

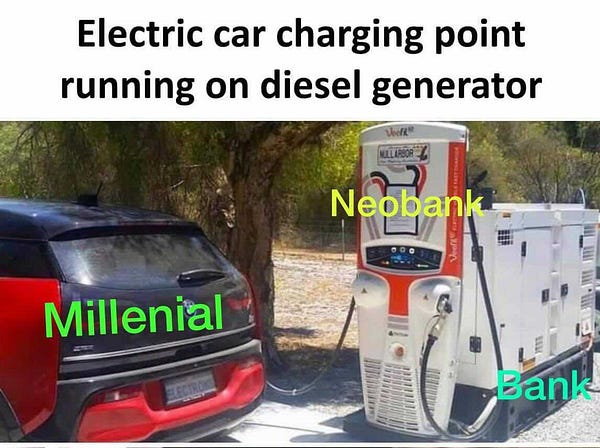

Challenger Banking 🚀

🇪🇺 Spanish based Dify, a ecommerce cashback platform created by internet browser Opera has hired PayPal and WeChat Pay veteran Allen Hu to run it as the browser adds fintech services for the 300m that use its browser.

🇬🇧 Earned Wage Access (EWA) platform Wagestream has signed a partnership with payroll services firm Symatrix.

🇬🇧 Revolut has exited the Canadian market after its 18 month beta trial in what has been a difficult market for challenger banks to break into due to regulatory barriers and customers loyalty to incumbent banks.

🇬🇧 Wise has been accused by its former Brazilian partner bank MS Bank of illegally misusing customer data. This week Wise has hit back and is taking its own legal measures after MS Bank terminated its relationship with them and launched a competitor. Hopefully this doesn’t dampen Wise’s reported UK direct listing this year.

🙌🏻 FATP Take - A head scratching affair which demonstrates a challenging business environment in Brazil for fintechs especially after Whatsapp Pay’s legal trouble with the central bank and its Pix offering. This alleged partnering and then copying may put more Western fintechs off the Brazilian market, which is one of Latam’s largest markets.

🇬🇧 Ikigai, a UK fintech named after the Japanese concept referring to “happiness in living”, has launched a combined bank and wealth solution in the UK which includes debit card, savings account and diversified investment portfolio in one app for a flat £10 per month fee, shaking up the traditional AUM fee approach.

🇬🇧 FundSense has launched to help asset and wealth managers remain at the cutting edge of technological innovation through its workflow automation.

Traditional Banking 🏦

🇪🇺 An Accenture report found that banks Board of Directors lacked technology expertise to maximise the benefit of their IT spend, with only 10% of directors and 10% of CEO’s having any professional technology experience. The US, UK, Finland and Ireland had the highest percentages.

🇬🇧 Santander has launched a calculator to help educate users on the effects of saving and investing for the long-term.

Payments 💰

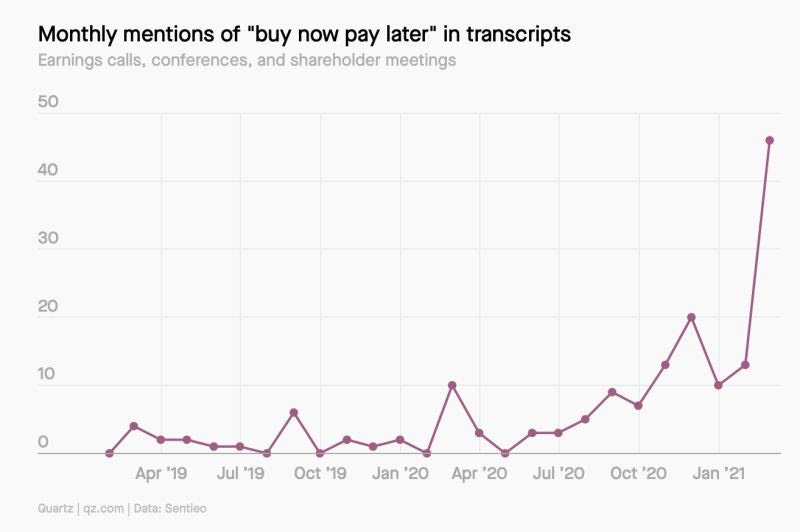

🇪🇺 BNPL provider Afterpay has launched its European Clearpay solution to merchants across Spain and France, with an Italy launch later this in March. BNPL seems to be the fastest growing buzzword amongst company executives recently

🇬🇧 Bottlepay is now live with its crypto social media feature which allows Twitter users to send and receive bitcoin via the Lightning Network. Cash App is also adding the ability to send BTC using $cashtags for free.

🇬🇧 UK fintech Agitate has launched an open banking powered payment solution called Bopp, which uses data aggregation and payment initiation to cut out card networks.

🇺🇸 Visa is facing increased scrutiny from the DoJ over its debit card practices which might be anticompetitive as Visa incentivises banks to limit merchants ability to direct debit transactions through unaffiliated networks. Visa is also reportedly set to raise its interchange fees on cross-border UK/EU transactions like Mastercard nearly 5x. Both networks recently announced they are delaying their US fee hike another year.

Longer reads 📜

Digital Dollar - Biggest Threat to V/MA - Tom Noyes

🙌🏻 FATP Take - This is my favourite read this week as Tom gives a great intro to CBDC’s and their potential impact on the USD and the payments system. I believe that the US needs to quickly ramp up its CBDC efforts or risk the USD losing its status as the world’s reserve currency. CBDCs also could have a huge impact on banks business models not to mention cut Visa and Mastercard out of the payment loop as it enables disintermediation. While there are various different CBDC models that might exist, some with more drastic implications than others, trials are underway in China with the Digital Yuan and the Bahamas with its Sand Dollar, the US is falling further behind every day.

The Apple moment for financial services - Giorgio Guliani

How Wells Fargo and Current keep digital banking novices engaged - Daniel Wolfe, American Banker

Unbanked stimulus seekers rush to open checking accounts - Ken McCarthy, American Banker

On Market power - Who Reads, Who Writes, Who’s SQL? - Amias Gerety and Nate Soffio

Your feedback is a 🎁, please give below 🙏

Good || Bad || Needs Improving

Follow me on LinkedIn and Twitter.

Michael