Tweet(s) of the week 🦉🏆 - Credit Scoring

This past week must have been designated automotive crypto week. With Elon Musk tweeting that you can buy a Tesla with Bitcoin, Fiat decided to one up the billionaire and combine automotive crypto with another huge trend, climate change. Fiat is offering new Fiat 500 electric owners free cryptocurrency for every kilometre driven. which can be redeemed at major brands such as Amazon, Apple Music, Netflix and Shopify.

The offering is powered by UK startup Kiri Technologies and its “KiriCoin”, with €0.02/1 KiriCoin per km according to the conversion. With the average 12,000km driven per year in Europe, this works out at €240. Not a blockbuster saving but if becoming more eco-friendly is your jam, a nice bonus!

Kiri is the more interesting piece of this as it is a crypto rewards/loyalty platform for sustainability, named after the Japanese tree that absorbs 10x the C02 that other trees do. With more companies jumping on the ESG/Sustainability/Climate Change bandwagon, Kiri could be an interesting partner to reward consumers for green behaviour to help broaden the appeal of sustainable behaviour. An API must be under development to enable brands to seamlessly plug into the Kiri platform. Another UK company Fidel is already powering the Google Pay loyalty platform and should prove to be a model for how Kiri could develop.

Crypto based rewards are getting more popular, with platform Lolli raising a round this week for its bitcoin rewards. The loyalty and rewards space has been tough to crack, especially with consumers double and triple dipping rewards. In my opinion a crypto based rewards platform on its own doesn’t solve any new pain points for merchants in the context of loyalty for the mass market who is generally price sensitive. Demonstrating you are driving net new spend is very difficult to do, maybe even impossible in a world with so many advertising and sales channels.

NB: Next Monday is a UK public holiday which I will diligently be observing so FATP will return on 12th April.

If you enjoy reading this, please subscribe and share! 🙏

Funding 💸

There were 49 deals in the fintech space across the US and Europe with total investment of $1.25bn. Some highlights are below.

🇬🇧 Blockchain.com has raised a $300m Series C giving it a valuation of $5.2bn from DST Global, Lightspeed and Vy Capital.

🇬🇧 Freetrade has raised a $69m Series B led by Left Lane Capital and included Draper Esprit.

🇬🇧 Wagestream has bought Australian counterpart Earnd in the fallout of the recently collapsed Greensill conglomerate.

🇬🇧 Meniga has raised nearly $12m in a debt and equity round led by Frumtak Ventures and Velocity Capital.

🇬🇧 Osu has raised a £2.25m seed round led by Creandum and included Ada Ventures, Breega Capital and Charles Delingpole.

🇬🇧 PPRO raised a $90m from Eldrigde and JPMorgan Chase.

🇺🇸 Greenwood, a challenger bank targeting the Black and Latino community has raised $40m in a Series A led by Truist Ventures and included a number of top financial service incumbents.

🇺🇸 Sivo, a YC Winter 2021 company, raised a $5m seed round at a $100m valuation for their debt-as-a-service API.

🇺🇸 AvidXchange is seeking a Q2 IPO at a $7bn valuation according to Reuters.

🇺🇸 Financial crime fintech Feedzai raised a $200m Series D giving the company a $1bn valuation, led by KKR and included Citi Ventures and Sapphire Ventures.

🇺🇸 Robinhood has finally filed for an IPO, somewhat surprising coming so soon after the recent GameStop saga and the increased regulatory scrutiny that followed.

🇺🇸 Pilot has raised $100m at a $1.2bn valuation in a round led by Jeff Bezos family office and included Index Ventures, Sequoia and Whale Rock Capital.

🇺🇸 Digital mortgage platform Maxwell raised a $16.3m Series B led by Fin Venture Capital and TTV Capital with participation from Anthemis and Rotor Capital.

🇺🇸 Creative Juice raised $5m in Seed funding in a round led by Inspired Capital and Index Ventures and included BoxGroup and Slow Ventures.

🇺🇸 Middesk raised a $16m Series A round led by Sequoia and included Accel and Y Combinator.

🇺🇸 Lolli, a bitcoin rewards platform, raised $5m in a round led by Seven Seven Six and included Serena Ventures and Night Media.

Challenger Banking 🚀

🇪🇺 NumberX, an Austrian based Curve competitor, is preparing to launch and is collecting sign ups for its beta.

🇬🇧 Five new fintechs emerged from Entrepreneur First this week which are Airbank, Hapi, Kettel, Lenkie and Zash. Their demo days can be seen here.

🇬🇧 Seedrs and Crowdcube abandoned their merger after the CMA blocked it due to the deal “reducing competition and innovation”.

🙌🏻 FATP Take - Both companies cited the need for a merger to better compete as both were loss making despite growth. Seedrs announced after the deal collapsed that it is raising new funds and that the business is strong, somewhat counterfactual given the rationale it sought for the merger.

🇬🇧 Curve is auctioning off five Curve branded NFTs for charity to support the theatre community in London.

🇺🇸 Both SoFi and Robinhood unveiled recently that they will start giving users early access to IPOs, democratising access to a process usually reserved for institutional investors and wealthy individuals who are investment bank’s best clients. UK based PrimaryBid has already been doing something similar including giving Deliveroo customers access to its upcoming IPO.

🇺🇸 Busy week for UK based Revolut as it applied for a US banking license so it can broaden its product suite and end its reliance on Metropolitan Commercial Banks and rolled out business accounts. How Revolut will differentiate itself amongst the incumbent challenger banks remains to be seen.

🙌🏻 FATP Take - The phrase “incumbent challenger bank” admittedly seems like an oxymoron but if the trend of challenger banks pursuing their own charters becomes a common theme, what happens to these smaller US banks who have been acting as their partner? Applying for a charter is a long and expensive undertaking and the usual rationale is to offer more products. It would see these smaller partner banks need to up their game to provide more products that fintechs are looking after if they want to retain them as customers. Selling technology products into these banks seems like a large market to take advantage of. The below study by ClearBank funds these partner banks in Europe somewhat lacking.

Traditional Banking 🏦

🇪🇺 BNP Paribas is launching a training program for its employees to raise their awareness of the environmental, financial and social issues resulting from climate change, as the firm looks to integrate more ESG into its products and client engagements.

🇪🇺 Santander is rolling out eco-friendly debit and credit cards across Europe, replacing its 30m cards over the next four years. It is also closing 111 UK branches and moving its HQ to Milton Keynes.

🇬🇧 TSB has rolled out its AI Smart Agent to its mobile banking app. Powered by IBM and created in five days at the start of the pandemic, the bot has handled 1m conversations with only 20% being passed to dedicated staff, helping alleviate pressure on customer service

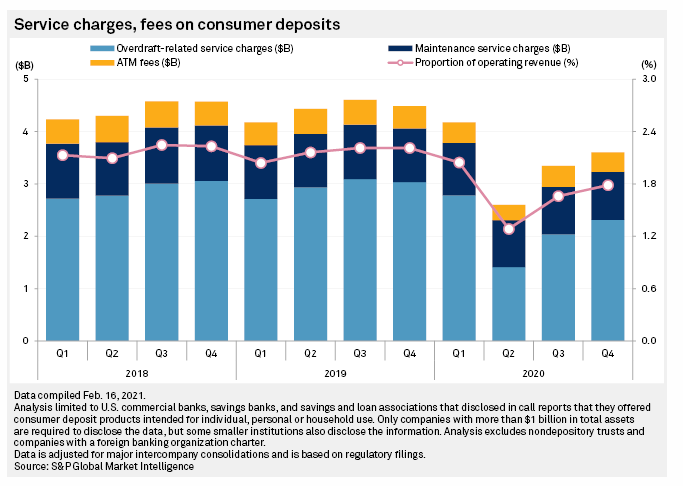

🇺🇸 S&P reported that overdraft fees collected by US banks increased 64% in Q4 2020 from the low of Q2 2020 demonstrating the rolling off of previous government stimulus measures driving consumers back to overdrafts. Overdraft fees accounted for nearly 65% of the total $3.6bn service charges in Q4.

🇺🇸 Citigroup has banned internal Zoom calls on Friday and is encouraging vacations to combat fatigue and burnout as well as designating May 28th, a firmwide holiday.

SME Banking

🇬🇧 HSBC is launching Kinetic, a SMB banking app, in direct competition to new fintechs. Kinetic offers debt and credit cards, cash flow insights, overdrafts and savings and has integrated accounting with Zero, QuickBooks and Sage.

Fintech Infrastructure 🚧

🇪🇺 SEB has selected Google Cloud to help its digital transformation for both its corporate and retail customer products.

🇬🇧 The FCA is going to use its legislative powers to expand Open Banking to Open Finance, covering a wider range of financial products but is wary about new risks and concerns over data ethics and digital identity. Open Finance is likely to place a large burden on firms but a coordinated approach will help. The first step they are advocating for is a minimal set of data to be shared on a “read” API basis.

🇬🇧 A study of 100 fintechs across Netherlands, Lithuania, Sweden, Switzerland and the UK by ClearBank found shortcomings in their experience with agency banks with 49% saying agency bank hasn’t helped their business, 12% saying they have inhibited their business with problems include outages and regulatory issues.

Payments 💰

🇪🇺 The German central bank said a distributed ledger for electronic securities settlement negates the need for a CBDC. Germany is leading the pushback against a digital euro due to concerns of the impact on its dominant banks but the ECB also hit out against misconceptions about the role a CBDC might play.

🙌🏻 FATP Take - ECB member Fabio Panetta refuted that its plan was to abolish cash, impose lower rates on a digital euro and disintermediate banks. Comments he made about the role of private capital markets indicate a less radical transformation of financial markets with a more wholesale approach to CBDCs with banks still facing the central bank and not consumers. Panetta also mentioned that the ECB doesn’t want to face a situation where European payments are dominated by non-European players, something it is worried about given the increasing dominance of US tech companies in current payments. China’s central bank has already said a digital yuan won’t displace Alipay and WeChat pay. China proposed global rules at a recent BIS seminar including interoperability and information flow synchronised but Fed Chair Powell commented a digital dollar would need stronger privacy. A wise man said 👇

🇬🇧 Starling, Wise, N26, Revolut, Raisin, Klarna, SumUp and Fire have set up Accept my iban, joining forces to stop the discrimination against UK to EU iban payments that some companies have started post-Brexit. This is a violation of EU rules but not an unsurprising move, I am sure the EU will be quick to resolve the issue.

🇺🇸 Payments giant Stripe reintroduced Link, enabling a one click checkout for businesses using Stripe Checkout. When questioned about this in the context of its investment in Fast, Patrick Collison said “we want to avoid the “we must win everything” mindset that can easily set it. We’d rather help enable a successful ecosystem”. Masterful quote from a founder who really gets it. It is hard to imagine a bank CEO saying that.

🇺🇸 Daylight, a digital banking platform built by and for the LGBT+ community is partnering with Astra for automated bank-to-bank transfers. Astra has also partnered with Dwolla and its new real time payments (RTP), helping businesses initiate faster payments with no chargebacks available any time of day.

🇺🇸 Visa has become the first payments network to settle a transaction in USDC, in partnership with Crypto.com and Anchorage, the first Federally Chartered Digital Asset Bank.

Regulatory Corner 🔎

🇬🇧 Wirex, a crypto payments company, has been forced to stop onboarding UK clients by the FCA until it builds up its AML checks and controls.

🇬🇧 Authorised Push Payments (APP) fraud increased 22% in number of cases in 2020 as the money lost was up 5% to £479m. UK Finance is calling for the government to include fraud measures in its new Online Safety Bill. Banks also need to help to stop fraudsters spoofing their phone numbers.

🇺🇸 Senate Democrats are planning to overturn the OCC’s “True Lender” rule that establishes a national bank as the true lender if it is named as the lender in a loan agreement or if the bank funds it. This means state interest rate caps don’t apply and has been used by payday lenders to skirt caps via national banks.

Longer reads 📜

How tokens could revolutionise the creators economy - Giorgio Giuliani

🙌🏻 FATP Take -The rise of NFTs has been stratospheric. In his latest piece Giorgio discusses how tokens can help spur on the creator economy by giving creators a way to convert their unconventional revenue streams into a token which can help bring them into the financial system. The article made me think about the steps that are necessary for this to happen. Either the platform or the individual creator needs to partner with a company that can convert a fiat revenue stream into a tokenised asset, not unlike a securitisation of mortgage payments into a tradable instrument. Or the platform could pay the creator in tokens not fiat. The future revenue stream would need to be valued and then sold/traded to investors. The middleman would act as the servicer of the token, passing fiat currency from platform to token investor. It seems that Pipe could do a lot of this, as could companies like Square, Stripe, Shopify and others that do similar things for their merchants could also get in on the NFT game. So many interesting problems will arise with the increasing use of NFTs in lieu of fiat income. NFTs could be a new form of securitisation for many financial instruments. If anyone is working in this space, then please reach out, you can find me on Twitter.

Walmart - Banking and Fintech - Tom Noyes

From Bowie Bonds to Pipe - Marc Rubinstein

Leveling the playing field - Alex Johnson

Open Banking: Rearchitecting the Financial Landscape - FT Partners

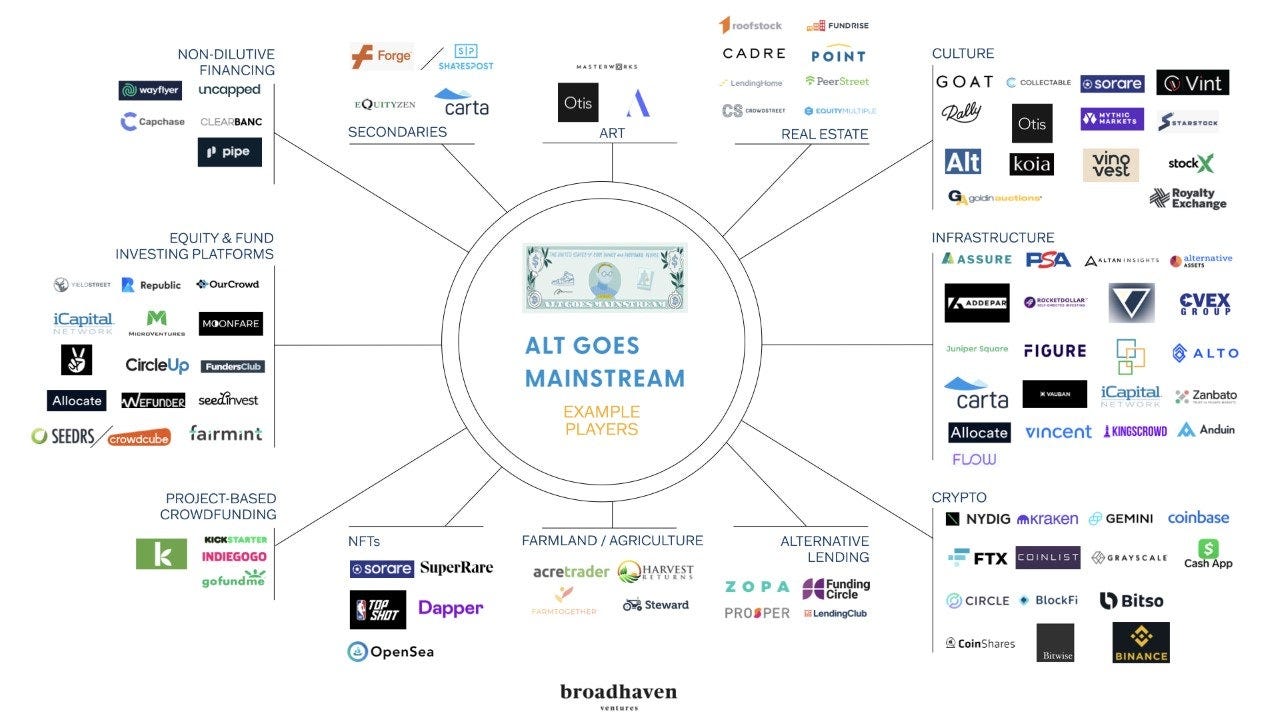

Alternative Assets are on the map - Michael Sidgmore

Tobi Lütke - The Observer Effect

Dating a founder - Amy Lewin, Sifted

Your feedback is a 🎁, please give below 🙏

Good || Bad || Needs Improving

Follow me on LinkedIn and Twitter.

Michael