"Alexa, pay my gas"

Tweet Highlight

Happy Labor Day to those in the US. Fred Wilson, a venture capitalist at USV sent out a noteworthy blog post today comparing the higher tax on labor (22%-24%) compared to capital (15%).

Amazon took a step further into payments this week with its new Alexa command. This week has also seen lots of news in the challenger bank space. As the industry faces crunch time due to Covid, the path to breakeven, let alone profitability, looks tough.

To continue to get updates delivered straight to your inbox please subscribe below!

Recent News 📰

CB Insights has listed its top 250 Fintechs in a logo vomit market map but can loosly be used as a proxy for the sectors within fintech that are booming i.e. Payments and Insurance.

Funding 💵

Sifted reported on the most active US investors in European fintech, shown below.

Embedded Finance

Embedded finance has come to parking, with Google Maps integrating with Passport to allow people in Austin, Tx to pay for parking directly from Google Maps.

Challenger Banking 🚀

Robinhood is in trouble with the SEC for failing to disclose prior to 2018 that it sold its clients orders to high speed trading firms according to WSJ. A fine is likely to be around $10m.

US challenger bank Current has teamed up with InComm, a payments technology company, to allow Current users to make cash deposits in physical retail chains.

Customers of Curve can now store their loyalty cards in the app.

Both Monzo and Starling Bank have announced new charges in a bid to reduce costs, increase revenues and reach break even. Monzo is charging 3% for withdrawals above £250 and £5 for a card replacement. Starling is also adding new charges;

£5 for a lost card

£2 per month for a children’s card

£2 per month for the Connected card aimed at vulnerable users

£2 per month for an additional £ account and £20 for a chaps payment

🙌🏻 As both companies strive to cut costs, new charges are being applied to accounts that are unprofitable for them to operate, aiming at nudging these customers to another bank or making them pay for the service. I would expect to see more of these moves over time in the industry and while customer numbers might drop off, the economics should improve remarkably.

Trouble at Revolut in the past week as customers faced delays in getting paid due to “technical difficulties”. With no customer support or communication, users took to twitter to vent.

Robinhood, TD Ameritrade, Vanguard and Schwab all reported technical difficulties last week with speculation that stock splits from Apple and Tesla were behind the issues.

Tandem Bank in the UK is focusing on savings and loans and winding down its credit card business

Traditional Banking 🏦

Wells Fargo launched a checking account with no minimum balance or overdraft fees, with the $5 monthly fee waved for 13-24 year olds.

🙌🏻 WF is late to the party here with Chime, Current and Simple already offering similar products, and more, with no fees. WF has had a bad reputation of late caused by numerous scandals so it would have been nice to see them going the extra mile with this new account but they have barely launched an adequate product.

Fintech Infrastructure 🚧

Modern Treasury, the business payments API provider, announced it reconciled $100m in payments in August, after 25% compound monthly growth since January.

Ocrolus was named 30th in Inc’s 2020 fastest growing US companies list.

Payments 💰

“Alexa, pay for gas” is now a recognised command at 11,500 Exxon and Mobil stations in US. Amazon uses technology from Fiserv to use the default payment option in the Amazon account.

PayPal has launched “Pay in 4”, its BNPL solution aimed at converting more consumers at the checkout and increasing basket size. Link

🙌🏻 As mentioned before, the BNPL space is very hot right now and has appeal for some consumers who might have opted for credit cards and their high interest rates or payday lenders. Affirm has interest rates of 15%, Klarna charges 19.99% and Afterpay charges $8 if a payment is missed, capped at 25% of the purchase cost. The average credit card interest rate for comparison is around 18%. It will be interesting to see how a user can manage all of these different credit plans from different BNPL companies from an operational and organisational perspective.

Dampening the heat from the BNPL sector were the widening losses at Klarna. H1 2020 saw losses of $63m compared to $9.5m last year. Despite losses increasing, its expansion in the UK and US was producing results, with net operating income up 37%, 14m new customers added in H1 2020 and a 550% growth rate for consumer onboarding in US.

Regulatory Corner 🔬

Wirecard assets continue to be sold, with digital identity firm IDnow buying the Communication Services unit. The Brazillian unit was sold to PagSeguro Digital and Wirecard UK Card Solutions to Railsbank. Wirecard North America are close to being sold.

Longer reads 📜

Ron Shevlin at Forbes - “Nobody wants an online bank”

🙌🏻 I broadly agree with Ron, people want a better solution for their needs rather than specifically a digital bank. The fact that the large incumbent banks, BofA and JPM have seen increases in customer satisfaction doesn’t mean that an online bank couldn’t provide a better solution though. There are almost 850,000 customer accounts at banks and credit unions according to FDIC and NCUA. BofA and JPM have 175,000 and the top five largest US banks by number of accounts have just under 300,000. So only 35% of the market have increased their satisfaction, leaving a lot more unknown. He also mentions that challenger banks with a specific focus or vertical are raising a lot of money and this could be where the dissatisfaction lies.

In a recent session with TechCrunch, Max Levchin of PayPal and more recently Affirm is looking for new fintech opportunities in SMB lending.

BIS working paper on the use of data by big tech firms in assessing creditworthiness. The paper found that the use of data by tech firms in lending could make collateral less necessary.

Deep dive into Stripe by Not Boring’s Packy McCormick.

The ideal embedded lender from SciFi Theses.

Latest Fintech Brain Food from Simon Talor.

A breakdown of SPACs by VC veteran Bill Gurley, an IPO critic.

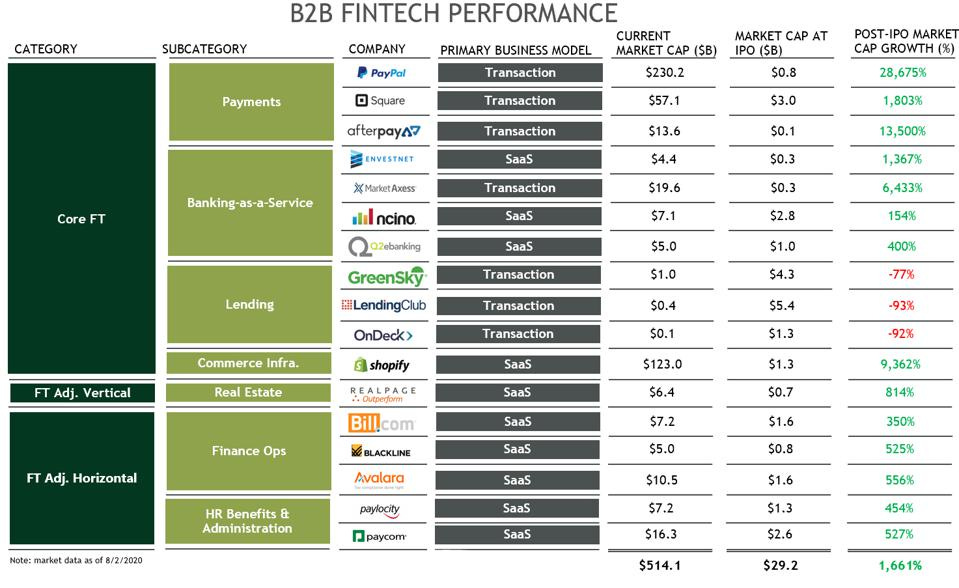

Patricia Kemp at Forbes - “What is B2B Fintech”. Patricia highlights the performance in public markets of what she describes as Fintech 1.0 and Fintech 2.0 companies. She sees the next wave, Fintech 3.0, broadening to inclide identity fraud and risk combining with tech trends of ML, automation and open source.

Startup of the Week ⭐

Bond is a fintech startup that is firmly riding the wave of embedded finance. Bond enables brands to integrate digital financial products into their services, connecting them to partner financial institutions to provide the heavy lifting in the background.

Bond has raised $42m to date, with $32m coming from its Series A in July 2020. Its cap table includes B Capital Group, MasterCard, Goldman Sachs, Canaan Partners, Coatue Management as well as prestigous angels from SoftBank, FT Partners and formerly of Morgan Stanley.

The company looks to be pre-product but will provide a seamless way to streamline the bank-brand relationship with its solutions. The marketplace approach should allow brands to quickly and easily pick a bank partner for a new product but also switch easily if needed. This will reduce the reliance on one partner in the event of an issue (think of fintech’s previous reliance on Wirecard).

Founder Roy Ng is an alum of University of California - Berkeley with experience previously at Twilio, Mapbox, SuccessFactors and Goldman Sachs.

Please get in touch to share your thoughts and comments!

Follow me on LinkedIn and Twitter.

Michael