SotW 🇺🇸🚀: Altan Insights - A community for alternative asset investors

Could Altan be the next Bloomberg?

Startups of the Week ⭐🇺🇸🏆

🚨FATP is now taking submissions for future Startups of the Week here.🚨

Altan Insights is building a community for investors interested in alternative assets. With interest rates low, wallets brimming with stimulus money and reduced expenses, people are looking for entertaining ways to spend their money from home. Piling into $GME or BTC is always an option, but increasingly investing in assets that you have a connection with is becoming popular. Younger investors want more from their investments than a pure financial return. They want to feel some sort of attachment with what they own. They want alternative assets.

Team

Altan Insights was founded in March 2020 by Russell Lieberman. Russell spent the first four years of his professional career at Bloomberg before moving to the buy side and becoming Director of Sales at REDI Global Technology. REDI was subsequently acquired by Thomson Reuters in 2017 where he stayed for a year before pursuing his MBA at NYU Stern.

His time at Bloomberg and Reuters provided him with experience seeing the fintech side of Wall Street and serves as the context and aspiration for Altan Insights where he aims to create a modern Bloomberg terminal experience for the alternative asset space, aka alt assets.

Altan’s team currently consists of Russell, Brett Sanderson the CMO, a tech consultant and a full time developer recently joined in early February.

Market

Before we dive deeper into Altan, it is important to provide some background context to alternative asset investing.

What are alternative assets?

The term traditional assets commonly refers to stocks, bonds and cash and so “alternative assets” is used to describe anything outside of these familiar asset classes. Conventionally, alternative assets is a term used to describe assets such as venture capital, private equity, commodities and real estate but more recently has been used to describe investments in tangible assets like art, watches, wine, sports memorabilia, collectibles, horses and cars. For the purpose of this piece, I will use the term alternative asset to refer to this new generation.

How does alternative asset investing work?

It all starts with a purchase of the underlying asset (be it a piece of art, a baseball card, a pair of sneakers etc) by a company. This asset is then securitised and ownership transferred to a new LLC company whose shares are then offered to the public (through an IPO or “drop” as some marketplaces call it) to be bought. Investors purchase and trade these new LLC company shares, with the LLC owning the specific asset.

Traditionally, when securities are offered to the general public for purchase, they are required under the Securities Act of 1933 to be registered with the SEC, unless an exemption exists. The reason for this registration is to protect investors from fraud by ensuring that potential buyers of securities receive complete and accurate information before purchasing. The offering company issuing the security must create registration documents and have audited financial statements. The offering company, underwriter and other individuals sign the registration statement accepting liability for any inaccurate statements with the purpose of giving investors confidence in the security. This registration process also creates a lot of legal work and expense, making the issuing of securities to raise small sums of money unfeasible.

However, within the Securities Act of 1933, Regulation A (Reg A) provides some exemptions from these registration requirements. It is these regulations that allow equity crowdfunding and also for alternative asset security offerings. In 2015 the SEC expanded Regulation A into two tiers;

Tier 1 - for securities offerings of up to $20m in a 12 month period

Tier 2 - for securities offerings of up to $50m in a 12 month period

It is under these new regulations that the alternative asset investment space has boomed because the securities they are offering mostly are exempt under Tier 1.

Where can I buy?

There are many platforms through which investors can buy alternative assets such as Rally, Yieldstreet, Otis, Masterworks and MyRacehorse. They are each targeting specific assets in which they specialise, which makes for a fragmented market but a big opportunity for Altan.

The word democratisation is thrown around a lot in fintech but with developments in the alternative assets space, access to investing is truly being opened to everyone. Securities issued under Tier 1 of Regulation A are available to the general public and in certain instances so are Tier 2 securities but there are more restrictions and sometimes investors must be accredited. Prior to the explosion in the alt asset space, if you wanted to invest in art or classic cars, you had to buy the whole asset yourself or find co-investors, making it unavailable to many. Not many people have the funds on hand to lock up in these types of assets.

How much should I buy?

Conventional wealth management wisdom indicates only a small portion of your portfolio be allocated to alternative investments because they are risky and often illiquid, but can provide superior returns over a long time horizon. For certain investors who can tolerate the illiquidity of the investments and are attracted to the superior returns, they are increasingly allocating 30%+ to alternative assets. Given the small investment portfolio of most retail investors, a small 5%-10% allocation of their portfolio would allow only for investments in the tens of thousands of dollars, reducing the number of alternative assets available for purchase. But with these new platforms that are opening up access, you can invest amounts less than $20.

How big is the opportunity?

There are two ways to think about how big the market is. One is to consider what the annual amount invested in these assets is. The second is how much investment could flow into alt assets given the right infrastructure.

On the first, the global collectibles market is estimated at $370bn according to Boxes CEO Solomon Engel with 200 million collectors globally. Although this pales in comparison to the $216bn daily volume traded on the Nasdaq, it is still a huge and rapidly growing market due to the benefits of technology and regulation advancements.

Institutional Investors

In terms of investable assets, a May 2020 BCG report shows that total global assets under management in 2019 was $89trn, which grew by 15%, with retail clients the fastest-growing segment. The report also notes that alternatives represent around 16% of AUM and is already a $15trn asset class, primarily made up of real estate, private equity and hedge funds. These are the traditional alternative assets which differ to the new age alternative assets that are being made available to retail investors. As investors, both retail and institutional, continue to search for returns in this low interest rate environment, even a small shift of this $15trn market will have sizable implications for alt asset prices.

Source: Institutional Investor

Institutional investors have been increasing their allocation to alternative assets for a number of years but retail investors and High Net Worth (HNW) individuals have not made the same shift, in large part due to the complexity of the traditional alternative assets and the high minimum investments required. With the democratisation of new alternative assets through the marketplaces discussed as well as the research, data and insights provided by Altan, this could change. Retail clients make up 42% of global assets under management at $37trn and a doubling of their current small holding of alternatives from 6% to 12%, would represent inflows of over $2trn. New alternative assets have both an emotional appeal to investors as well as simplicity. A baseball card or piece of art is easier to understand than a private equity or hedge fund investment.

Altan can look to companies that dominate the traditional asset landscape and their associated market cap’s for inspiration: Bloomberg (~$60bn estimated), S&P ($81bn), MSCI ($36bn) and IHS Markit ($37bn). Bloomberg represents the most natural model for Altan to replicate as it has tight control over financial data, it is a social media company specialising in the financial services industry and dominates the attention of financial market participants globally. Bloomberg started off providing real-time market data and analytics to Wall Street through its infamous terminal and later expanded to a trading platform, chat features, news and events and magazines. It has also acquired data businesses New Energy Finance and Barclays Index and Risk Analytics to further build out its moat.

With the proliferation of new marketplaces in the alt asset space as the ecosystem rapidly expands, there is a gap left to fill for a third party that can gather up and aggregate data sources to provide a one channel for investors which should be the priority for Russell and Altan. As Marc points out in his piece on Bloomberg, back in 2016 Morgan Stanley calculated that Bloomberg could be replicated for 10% of the cost by stringing together alternative data sources, but doing so gives rise to potential security breaches, downtimes and an overall bad UX. This is what Altan needs to pay close attention to.

The whole alt asset space, much like e-commerce and retail stock trading, has benefited from the pandemic with many people stuck at home with little entertainment and money to spend due to lower expenses and stimulus checks. The nostalgia associated with the sports collectibles space specifically has been enhanced with people working from home. The alt asset space has a buzz around it like cryptocurrency did back in 2016 before it had its big run up in late 2017 and 2018.

Source: Otis

To continue reading about Altan’s product, business model and what the future might hold, click below!

Product

Content

Altan Insights is a community and content provider for alternative asset investing. They provide research, data, interviews and digestible financial analysis to investors interested in alternative assets. For investors new to the space, it is a one stop shop for content that you need to get started, to make better investment decisions and to stay informed. Currently they are focused on marketplaces that offer Reg A securities and are taking a narrow but deep stance on the ever expanding market.

The alternative asset space is very nascent and lacks the infrastructure that the traditional stock market and bond market has, through the aforementioned public companies. There is a lack of transparency around prices, a lack of information about what investments are being sold, where and when they are being sold and what the fees are. This is all information that is taken for granted with investing in the stock market with the wealth of information that is available online from the companies themselves, third party research companies and financial market analysts. A lot of it is driven by regulatory disclosures, especially in Europe. Any attempt to regulate the information disclosures in alt asset space should be an opportunity for Altan.

Source: Altaninsights.com

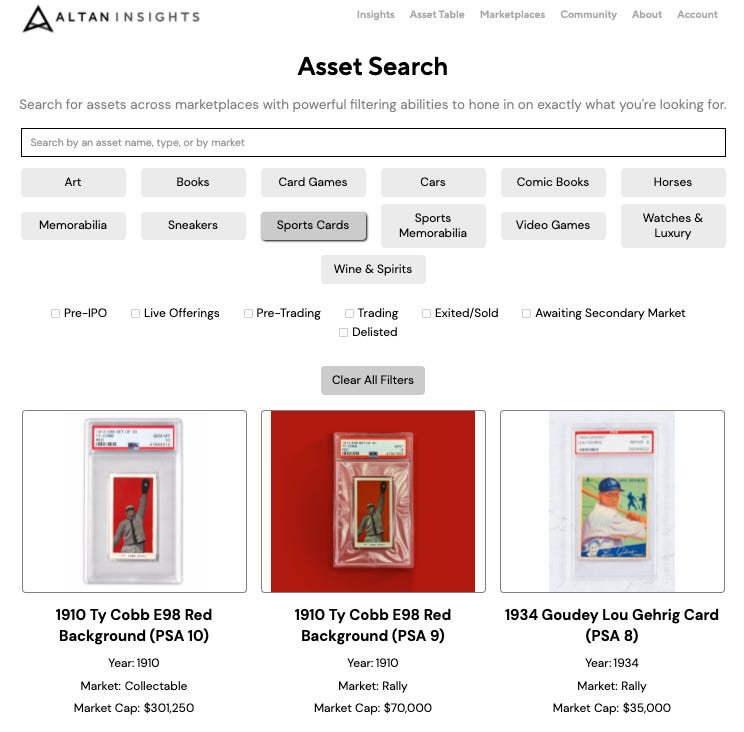

Altan produces a weekly summary of upcoming offerings across the platforms they partner with letting investors know of what opportunities are available and when. They also provide an asset search tool to provide price discovery of various types of investments to help investors with their diligence. There is no Google Finance for alt assets but this is a key role that Altan is seeking to play. Currently the asset search tool consolidates assets for comparison within a particular subsection e.g. sports cards which helps identify underprice assets. For example if you were looking to invest in sports cards, you can see the two Ty Cobb cards above have vastly different market caps which could help your investment selection. As trading expands, Altan will provide price history for assets a la Google Finance (below).

Fictional representation of what Altan could create in the future

Twitter has served as a primary market for Altan to deliver its content and they are starting to attract more serious investors of the marketplaces they cover. Their typical investor is young, between 25-45 years old, as these investors are more open to non-traditional asset classes and have often like to have a connection or positive affinity for the assets they buy which is why they like alt assets. While the cost of a Birkin bag may be out of reach for many, you can invest in a share of one with Otis. Or invest in an asset like a Pokemon card or sports card that reminds you of your youth, which also may increase in price. No other investment pulls on the emotional and sentimental side of human nature like these alternative assets.

Currently each marketplace is specialised in particular sectors of alternative assets and provides some level of content and community that is similar to Altan’s but investors need an independent aggregation of this information across the multiple marketplaces. Altan currently lists 16 on its website with more likely to crop up. With the fragmentation of the industry and very bespoke data points which are important for each sector, an aggregator like Altan is needed. As an example, data points like year and vintage are very important for wine and whiskey investors but less so for fine art and luxury goods.

Community

Altan has a list of market places that consumers can easily access, providing an aggregated list of venues where various assets can be traded as well as a community section which provides a place for investors to exchange trade ideas and talk about different platforms and assets they are interested in. This is also a vital piece of the puzzle both for the alt space as well as for Altan.

Community support is crucial to expanding the ecosystem so existing and prospective investors have a place to go to ask questions and find like minded people. For Altan, the community element is a key resource for them to build up as they seek to offer new products and services for this community. One only has to look at the success of Seeking Alpha, the largest investing community in the world with over 15 million unique visitors and 40 million monthly visits to see what this element of Altan could become. By providing a space for investors to engage, discuss and discover investment ideas, Seeking Alpha has grown to a substantial paying subscriber base of 70,000 and ARR of nearly $17m from this revenue stream alone.

Business Model

Altan is primarily pursuing a B2C business model at the moment but significant opportunity lies in B2B products further down the road.

B2C

Altan currently generates revenue through sponsorship of its newsletter but is looking towards generating premium content and expanding its tools for its community of investors in the near future. It’s go to market strategy has been to distribute its content via Twitter, gaining 2,400 followers to date, and its own website. The use of content as a user acquisition strategy has been a successful one historically, with Mint.com famously built up its content on a tight budget in its early days and attracted 20k email subscribers and is something Altan is hoping to replicate.

Engaging and relevant content itself can become a flywheel to drive more users to the Altan website who then are more likely to invest via partner marketplaces who in turn grow and are increasingly likely to feature Altan content which expands the whole market. This strategy is inexpensive and suited to Altan’s current early stage but as the company puts more resources into acquiring customers, social media marketing will likely increase customer acquisition costs as its target customers are highly fought over.

The current B2C offering is not very defensible, with the space developing rapidly, there are likely to be other competitors who are looking to aggregate data and information across the fragmented ecosystem. As the marketplaces themselves expand, they may also start to creep further into the content space. Otis already provides a “Market Report” on each of its drops to include details on the asset, its independently appraised values, context around the asset, macro research on the category growth, relevant historical pricing of other similar assets, how Otis evaluated the asset and key metrics (sample Banksy Market report here).

What will provide a more defensible moat is exclusive or time periods of exclusivity in data from marketplaces which could be crucial for Altan to establish itself as the leader in the space.

B2B

Although the company is initially focused on B2C products, over time as the space develops and more businesses and institutions want to get involved, there will be interest for the raw data which Altan can monetise. Data is a high margin product with near zero marginal costs and Bloomberg has successfully packaged financial data and created a very valuable business which is something Altan could replicate.

Incentives

The marketplaces themselves have so far supported Altan and viewed the company as a valued partner. The marketplaces realise the role that Altan plays in generating valuable content and raising awareness of their platforms and assets. They provide a gateway and channel for investors to discover marketplaces to trade which is why they have been quick to integrate Altan content into their apps and establish themselves with Altan’s investor community. The popular saying “a rising tide lifts all boats” describes the relationship, one of joint interest. Both sides are incentivised currently to support each other and grow the pie but this could quickly change if one expands into the other’s territory so lines in the sand should be drawn so co-operation continues. Altan needs to remain the independent source for content and aggregated data but it should tread carefully if it tries to own the investor relationship too deeply.

Business model defensibility

The most obvious way for Altan to thrive is capturing unique data from its community and the marketplaces that it partners with to create a data moat that is difficult to replicate. Either through exclusive access, first mover advantages or dominating the investor community, Altan can protect its business from future competition and build additional products on top of this data.

Looking at the Altan through the lens of Porter’s five forces, Altan faces two main challenges, the bargaining power of suppliers and the threat of new entrants. The key will be to navigate the relationships with marketplaces carefully to remain on good terms as they provide critical data for Altan. As mentioned previously the marketplaces may dive further into the content space and so a tight relationship with them is needed to avoid stepping on any toes and to ensure collaboration doesn’t turn into competition. The space is big enough for both to succeed and ensuring product roadmaps don’t clash is important. The threat of new entrants has been touched on and Altan needs to ensure it creates a defensible moat through data to prevent competitors gaining traction and leveraging its close relationships with marketplaces is key for this.

Investors have little alternative currently as Altan is one of the only companies aggregating data and content across the fractured space and so there is not much opportunity for buyers to go elsewhere. For buyers interested in one type of alternative asset, they may choose to just look at content from one marketplace but Altan should be able to attract them with additional functionality if they are a serious investor, who are more likely to pay for Altan’s future premium subscription. The threat of substitutes is most likely to come from the marketplaces themselves, but with their focus on growing the assets available to purchase and creating a trading platform for users to buy, they are preoccupied and will likely look to continue to partner with Altan to provide third party services. Marketplaces will also understand the value in partnering with an independent third party that is also plugged in to the other marketplaces for different assets which can increase their investor reach. One threat could be if the major marketplaces get together to create a similar offering but this is likely to not be on their roadmap due to other priorities.

Future

As with any emerging asset classes, there are many opportunities to create the infrastructure around the trading of these assets with custody, reporting and valuation, which are needed to legitimise and attract institutional inflows. The Alt space isn’t quite at that stage yet but could be in the next 24 months.

Data

Data should remain at the heart of Altan’s future and provide it with a robust moat for its business. Providing users premium tools and functionality could enable Altan to capture more data of investor preferences (art, cars, horses) as well as trading data that may not be accessible otherwise. This valuable data will form the foundation of future revenue streams for the company. As the space grows and more investors participate and more trades are done, Altan will need to continue to scale their functionality over time with automated connections to marketplaces. Altan could provide similar functionality as CommonStock whereby brokerage accounts are connected to automatically feed this data in.

By having exclusive partnerships with marketplaces and capturing unique data from its investor community, Altan can become the aggregated source of truth for price and ownership information for alternative assets. Upon this data foundation additional products can be built.

Financial Services Partnerships

Although Altan is starting off with building content and data moats around the alternative asset space, over the long term they could expand into other financial services such as insurance. With both marketplaces and investors purchasing tangible assets, they will need to have them insured to protect them from losses and partnering with relevant insurance companies could also be a revenue stream.

Altan could seek distribution partners in the future such as digital wallets Cash App and Venmo. These digital wallets are looking for ways to increase engagement with their users and have started to offer stock trading and bitcoin purchasing, adding alternative assets could be the next addition. This distribution channel would present a huge growth opportunity for Altan and the space in general as Cash App and Venmo have over 60 million users combined. Alternative assets would also align with the target age demographic of digital wallets.

Geographic Expansion

Another obvious area for expansion is geographic. Canada represents a very similar culture and investor interest in the alt space is picking up. In Europe the culture around collectibles isn’t as hot but other areas such as wine, whiskey and art provide ample opportunities for expansion. The sneakerhead culture is active in Europe with many brands producing bespoke colours and exclusivity for Europe which could be attractive for overseas investors pending the right regulations.

Community

The growth of the community element could also mirror what CommonStock is building, where investors can follow the success of other investors and interact with people they follow. This can provide a platform for successful investors to create a following and potentially monetise in the future. With the industry in its infancy, encouraging more social and community elements is critical for continued growth

Both the data collected and the community features enhance the ability for Altan to understand what the investors on its platform are interested in creating a valuable flywheel.

High Net Worth Individuals (HNWI) already consider certain alternative assets as legitimate e.g. fine art, but as the space develops and infrastructure and data on other asset classes such as watches, cars, wine and whiskey become available, their interest could naturally expand to these more nascent sectors which could provide better returns. Altan will be the place they are already familiar with through their content and community elements and accessing data on new spaces could prove lucrative.