What is Apple's end game with payments? Part 2

Insights into Credit Kudos acquisition and Project Breakout

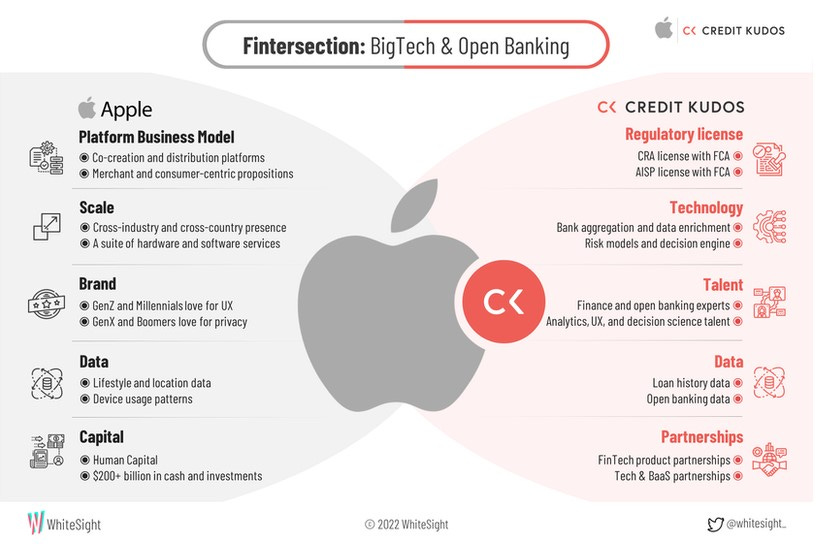

Apple has been in the headlines a lot so far this year in relation to the fintech space, firstly with their announcement of “Tap to Pay” which I covered in a previous post and more recently with its acquisition of Credit Kudos and subsequently with reports of Project Breakout, both of which I aim to cover today.

Credit Kudos

Towards the end of March it was announced that Apple had acquired open banking credit decisioning platform Credit Kudos (CK) for $150m. Credit Kudos uses open banking to provide affordability and risk assessment in the lending decision making process. Freddy Kelly started Credit Kudos in 2015 and had raised nearly $10m to date from investors such as Albion, Plug and Play, Ascension as well as angel investors such as Christian Faes and Charlie Delingpole. It’s laundry list of clients includes;

247 Money - car finance provider

Curve - card aggregator

Raylo - gadget subscription provider

Atom Bank - neobank and lender

LendInvest - property finance

Admiral - insurance group and loans

Zilch - BNPL

While surveys and research found that lenders and neobanks would increasingly use open banking in the coming years, the company struggled to breakout like other open banking infrastructure providers such as Yapily, TrueLayer and Tink. I am not sure on the specific reasons for this but it could be that such a competency is key for a potential customer that most decide to build in-house. Incumbents likely will take this route and lending is a difficult space to get into for new fintechs, there is not a wealth of new consumer lending businesses starting up. I am all ears if you have any ideas (drop me a message or leave a comment below).

However Apple swooped in and bought the company for $150m and some of the potential uses of it I discuss below.

Apple Card UK Launch

The Apple acquisition came as a surprise to most in the industry but when you look deeper at Apple’s ambitions in the space, as I wrote previously, it makes a lot of sense. Apple is likely to bring its Apple Card to the UK soon and although I would anticipate they partner with an issuer, like they did in the US with Goldman Sachs, having the experience of Credit Kudos means they can play a bigger role in determining credit eligibility. This gives Apple greater position of leverage and ultimately more control, something it wants given the discrimination lawsuits the card faced in the US.

Although the New York State Department of Financial Services found that Goldman Sachs was not discriminating, from a brand perspective it hurt Apple and they want to avoid this in the future. They can do that if they have the credit underwriting technology themselves and own that part of the process.

Apple Pay Later

The use of CK gets even more interesting when you consider Apple’s rumoured BNPL ambitions. Whilst the BNPL sector currently has no required checks on affordability and generally is unregulated, the FCA’s Woolard Review into the unsecured credit market is looking to change that. By acquiring CK, Apple has acquired the technology and experience it needs to do affordability and credit checks for its potential BNPL product, reducing the need to either build this from scratch or partner with another entity.

Apple controls more of the stack, which is something of a trademark for Apple. Who takes the credit risk here remains to be seen, although it is unlikely to be Apple but potentially a partner. However, Apple does have a large amount of cash on its balance sheet that it could lend this out but due to the mentioned incoming regulation, would require regulatory experience and I am not sure that is something Apple wants to dive into given its predominantly consumer focus.

Apple Pay A2A

Other suggestions include CK being used to allow consumers to use Apple Pay to do account-to-account payments, i.e. direct from a bank account. Whilst this is technically possible, I don’t think is very feasible. Apple would unlikely be able to collect its 0.15% fee that it takes with Apple Pay from A2A and so would lose a source of revenue. It is also counter to its Apple Card ambitions as well as CK’s status as an AISP (account information service provider) and NOT a PISP (payment initiation service provider) .

Apple Hardware Subscription Service

Apple is also rumoured to be working on a subscription service for its hardware devices, something similar to what other electronic subscription platforms and telco’s do. This would require affordability and credit checks of which CK could perform, complementing the consumer data, risk and fraud capabilities Apple already has and keeping data in-house rather than have it leave the Apple ecosystem. This is the most plausible of the listed options in my opinion.

Apple could also have acquired CK’s technology and talent to provide it experience in underwriting and risk assessment for its latest announcement, Project Breakout.

Project Breakout

As mentioned above, Apple likes to own as much of its technology stack as possible, increasingly becoming vertically integrated. This can be seen in hardware with the recent push into designing its own chip and it now appears Apple is looking to bring more of its payments stack in house.

As Tom Noyes outlines, Apple is the single largest online retailer with direct and indirect GMV of $800bn, surpassing Amazon by leaps and bounds. By bringing payments processing in-house, it will allow them to reduce processing costs but also give them more control of the payments experience as well as increase the pace of innovation as they are less hamstrung by third parties. As it looks likely that their App Store take rate is to be reduced, reducing the processing costs will go some way to offsetting that and provide consumers with a cleaner payment experience on its devices if it owns more of the payment stack.

As one of the largest retailers, Apple has an envied position of power when it comes to getting low processing rates but even these cannot go to zero and Apple clearly believes it has the experience and data to further reduce risk and increase acceptance rates beyond what partners can do. Apple could combine location data from devices, payment information and browser information to better authorise transactions.

By having more control over its payment processes, Apple will have more flexibility to expand its financial products to new markets. Something I missed in my part 1 post was Apple Cash. In the US Apple partnered with Green Dot for its Apple Cash product, a virtual payment card and bank account, which I feel has gone somewhat under the radar. This is a digital stored value wallet and is the backbone of Apple’s P2P play which is neatly integrated with iMessage (something Whatsapp should have done years ago!). Apple Cash only works on Apple devices and locks users deeper into the ecosystem. If it becomes widely used for P2P payments, it could replicate the success of Venmo and with Apple’s push into merchant POS with “Tap to Pay”, a closed loop payments system is not many steps away if it was something they desired.

It must be said, the lack of take up of Apple Pay, Apple Card and Apple Cash is something that clearly needs to change for this to happen.

The announcement of Project Breakout is a clear signal that Apple is getting more secretive about its financial services and wanting to keep its cards closer to its chest as it expands its financial services which is super exciting.

Apple + Crypto

I’d be remiss to not mention the recent integration of Apple Pay to Metamask. This was an exciting step for Apple into the crypto space, making the on-ramps even easier. This means in theory you will be able to use Apple Cash to buy crypto through Metamask. Could Apple’s push into the merchant space mean they are looking at helping them accept crypto too?

As always the above is designed to be a somewhat unstructured stream of thoughts. I welcome being challenged on them as I feel like the best way to learn is to do so in public so feel free to reach out to provide any feedback/comments below.

Fintech News Highlights

🇪🇺 N26 has been banned from signing up new customers in Italy due to concerns around money laundering. It has also had its user growth limited in Germany.

🇪🇺 The EU passed rules that reduce the anonymity in crypto, requiring exchanges to identify payers and recipients of crypto transactions through KYC requirements for non-custodial wallets.

🇬🇧 Revolut is partnering with Allianz to bring travel insurance to Premium and Metal account holders.

🇬🇧 Secretary to the Treasury John Glen announced incoming legislation to bring stablecoins into the UK payment framework at IFGS2022.

🌍 Some US banks have joined together with Early Warning with a service called Authentify that lets users verify their identity with their bank login details when on participating businesses sites or apps.

🌍 Payment app Strike is partnering with Shopify, Blackhawk Network and POS provider NCR to allow merchants to receive dollars when users pay with crypto

Your feedback is a gift, please give below 🙏

Good || Bad || Needs Improving

Follow me on LinkedIn and Twitter.

See you soon!