Eco Wants to Cut Out the Middlemen - What Will Happen If They Succeed?

Since this is the first post since I joined forces with This Week in Fintech to create This Week in Fintech UK & Europe, I wanted to provide some more context around what to expect from FATP in the future.

I’ll be posting less frequently than I did in the past, with the weekly news roundup content now being distributed via TWIF UK & Europe but I wanted to retain FATP as the home of my long-form content and collaboration pieces on the fintech and crypto ecosystems.

I am currently working on some great pieces and am excited to kick off with the below piece in collaboration with Luca Prosperi at Dirt Roads!

Power Is Nothing Without Control

In July 2019, only USD 2b of value was committed to DeFi projects. Today Ethereum - DeFi’s blockchain of reference, supports the circulation of over USD 80b of USD-pegged crypto-coins. Corporate updates came along. On the 18th of June 2021 Compound announced their Treasury product for businesses and institutions, advertising yields of 4% for USD deposits - via a swap into crypto-tokens. On the 8th of July Circle announced it was merging with Bob Diamond-backed SPAC in a USD 4.5b deal - Circle is the principal operator of the USDC stablecoin. On the 31st of August Consensys reported that their Ethereum-focused Metamask product had surpassed 10 million monthly active users, growing 1,800% YoY and positioning Metamask as the leading non-custodial wallet by number of users, globally.

Such growth and dynamism would have been astonishing per se, even without taking in consideration the set of awful UX challenges that DeFi users have to face when operating within the space. Although those frictions could somehow constitute barriers to entry that are conducive to the profit-taking activities of sophisticated arbitrageurs, they act as almost insurmountable obstacles for the wider public. The many smart people among traditional banking operators know and enjoy this.

This is why, on the 27th of July, the tweet above attracted our attention. Eco, a neobank/ non-bank personal finance/ consumer balance app, had just received USD 60m of funding from world-renown venture capitalists such as Activant, L Catterton, and a16z. This was the end of July, back when USD 60m was a lot of funding money in the crypto space. We must admit that if the announcement would have landed after Sorare’s recent mind-bending USD 680m Series B, the impact on our cerebral cortex would have been different.

But timing is everything in life, and the announcement was powerful enough to let ourselves ask what was Eco actually trying to disrupt? At Fintech Across The Pond and Dirt Roads we have been following two underlying tectonic movements happening in the financial services space: the first, core domain of DR, refers to the decomposition and rearrangement of so-called financial primitives facilitated by the DeFi revolution, and the second, closer to FATP’s heart, is the development of better-structured and tailored UIs allowing users to access financial services (and DeFi) more effectively. The Eco project seemed to combine both: a simple and direct user-oriented interface leveraging in the back end a rewired financial infrastructure. It was therefore only natural that we decided to join forces for this week’s post.

From Eco’s website:

But unlike most other people in the cryptocurrency space, we’re not trying to convince you to invest dollars or other fiat currency in some new, volatile asset. No, we’d like to build great products for you using existing currencies (like dollars) and slowly migrate to this new system to make life faster, cheaper, and easier — to make your money work for you.

Eco: Rewiring and Demystifying Personal Finance

Eco is explicit in telling you that it is not a bank. Mostly because that is part of its selling point, but also because of issues other fintechs like Chime have had with regulators when calling themselves a bank. But Eco is better than a bank. You can earn higher interest rates - although not being a bank means those cannot really be called interest, and higher cashback, by cutting out middlemen. Ultimately, Eco defines itself as smarter than a bank, and doesn’t want to be associated with their lackluster predecessors.

But if Eco isn’t a bank then what is it? It is an account that allows you to spend, send and save. Sounds pretty much like a bank, but digging under the hood is where it gets interesting.

How Eco Works (Based on What We Could Reconstruct)

Depositing USD but saving in USDC → Once users download the Eco app, they set up an Eco account and can make a deposit from their fiat bank account through linking it via third party integrations Plaid and Wyre. During onboarding, a user goes through fairly standard KYC checks for address and identity. Once a deposit is made, Eco shows a USD balance but in fact a user's dollars have actually been converted into USDC and placed in a crypto wallet via another partnership with Prime Trust. These deposits earn up to 5% - after referrals, which is definitely not to be confused with the 0.5% or lower most US traditional institutions are offering.

The gift card concept powering cashbacks → Users can currently only interact with five merchants to spend their Eco balance - luckily these are not small merchants but Amazon, Doordash, Instacart, Uber and UberEats. To do so, Eco uses a gift card concept where you can click through the Eco App to which merchant you want to spend at, input how much you want to spend and then generate a redemption code - this has essentially created a gift card for that merchant that you can use when you buy something and checkout. Refunds however have to be managed directly with the merchant. Upon the spend users receive 5% cashback, in actual cash not points or tokens, settled on a monthly basis. Whilst there are credit cards that have similar levels of cash back, these require high credit scores and often have other strings such as annual limits and card fees. Although this isn’t clear from what is shared by the company, we believe Eco moves USDC back to fiat and then to these merchants using the same infrastructure as the deposits - Wyre + Prime Trust.

Eco points supporting the Eco-system → The Eco-system is powered by Eco points. You can think of these like Amex reward points which incentivise sticky users and help develop a community around what Eco is building. There are two types of Eco Points: Eco Discord Points, earned through participation in the Discord community, and Eco App Points, earned on top of the cashback for spending with Eco at a rate of 2.5 points per dollar. Whether the firm has plans for those to become ERC-20 tokens that you can stake, redeem or trade hasn’t been shared yet - Eco has been eager to point out that these do not currently have monetary value.

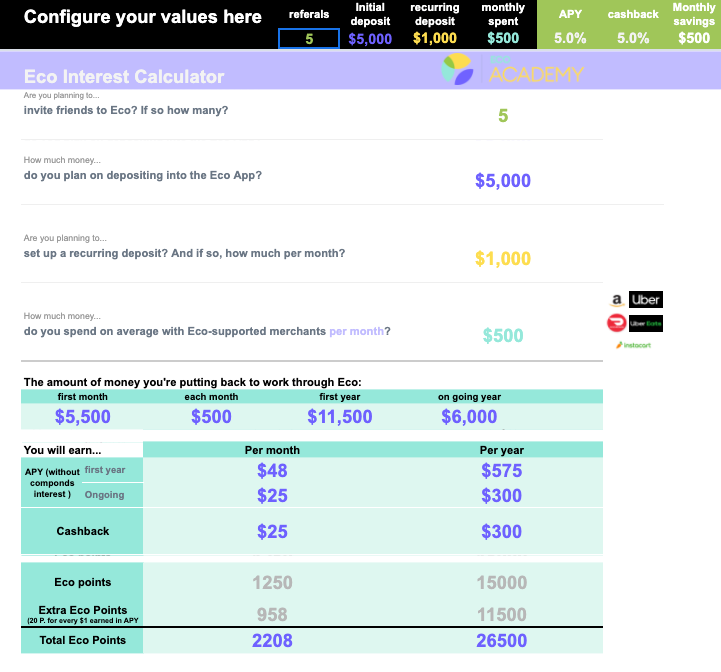

Get full visibility of the achievable savings → Eco offers a calculator for potential early users to see how much they could save through using Eco based on how many people they would refer, how much they would deposit and how much they would spend. The intention is obviously that of letting you switch away from a traditional bank - something that is highly unlikely to happen given the still clunky spending experience. Eco is still in beta and the testers are highly likely to be people interested in the crypto space who are early adopters and don’t mind an immature UX; to get the broad adoption they are clearly marketing towards will take a lot more UX improvements.

That isn’t to say Eco has done a bad job. The DeFi space is incredibly unfriendly to use and the intention to abstract away a lot of complexities for the common users is laudable. Users don’t have to buy stablecoins themselves or set up a wallet or interface with a liquidity pool to lend their USDC and benefit from the yields. Given how early we are along Eco’s journey, things could get significantly better. As a first taste of this, an Eco card is in the works which will be able to be used at any merchant, bypassing the gift card route.

Open Questions to the Community

Eco wants to build a self-enforcing system that attracts a sticky customer base, retains their structural excess liquidity, and connects with liquidity users by becoming a modern version of what customer deposits have been for decades in TradFi. All this by eliminating the slow bleeding traditionally caused by frictions and intermediaries. Going back to the whiteboard and redesigning retail banking is a monumental feat, and we remain curious to see how Eco will master the phases that lie ahead. Nevertheless, there is today a set of open questions we haven’t been able to answer through the information shared by the company on all the traditional channels - Discord, Twitter, their website. We highlight the most important ones below.

(1) Eco is not a bank, so what are the guarantees for the depositors? Eco is making clear that funds deposited won’t be protected by the FDIC. They are also clearly stating they don’t believe this protection is of real value for investors. We are not debating this statement, but their ability to access retail funds might be curtailed by the regulator if those same funds are used in a security (!) such as USDC.

(2) How’s Eco funding the high cashback rates? Using gift cards saves merchants from paying interchange which averages around 2% for credit cards. So where does the remaining 3% come from? Eco claims merchants save the rest from affiliate fees and ads on social media - the latter raises questions whether these five gigantic merchants really do save that much from getting customers direct from Eco. Not all merchants will be able to afford paying this cashback in our minds. We also hope that cashback is not funded by venture dollars.

(3) What is Eco’s degree of independence vs. their payment partners? Differently to what has been happening for some (although not all) BNPL players recently, Eco doesn’t onboard merchants/ customers on their own proprietary rails. With partners such as Plaid and Wyre, what is the degree of independence of the company over those partners? Is there a plan for Eco to integrate value transfers on their native platforms - or on-chain, when a critical mass has been reached?

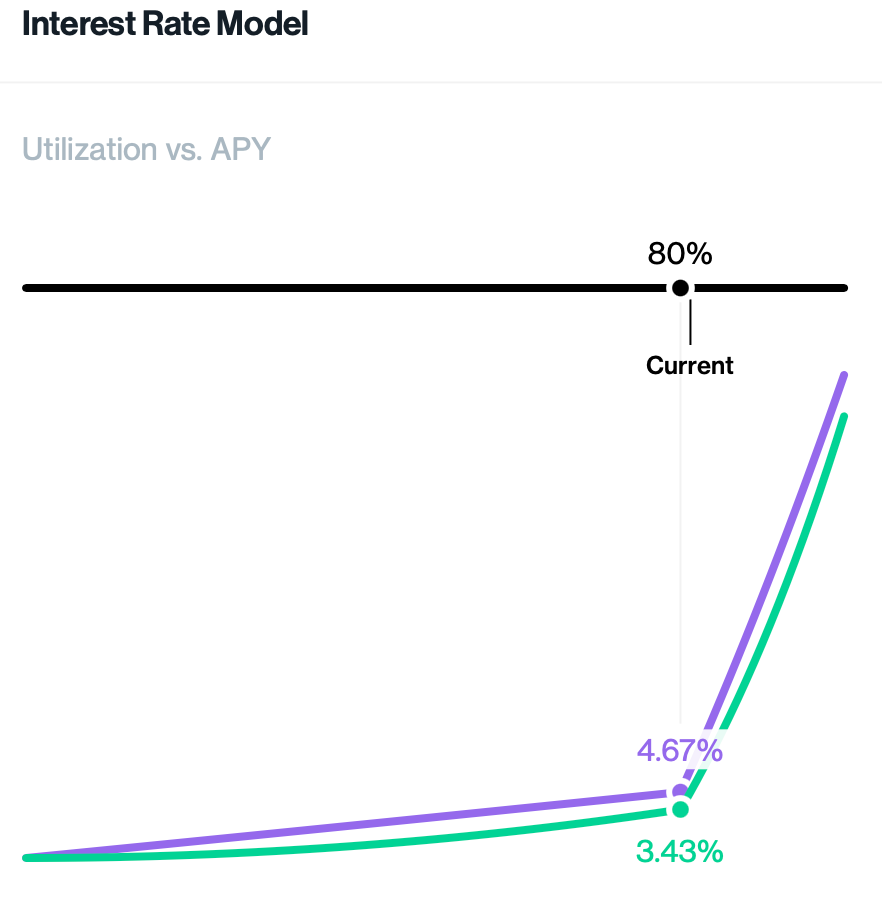

(4) How does Eco achieve such high interests on USDC? 5% is higher than what the market has been averaging on USDC deposits before the most recent downturn. Eco affirms that those rates are achieved by providing a one-stop shop to top tier financial institutions for accessing sizable and stable pools of capital. This makes sense to a degree but a question still looms as to why top tier institutions would pay 5% (or more, if Eco is taking a positive spread) to borrow, when pools can be accessed dynamically throughout DeFi. As a reference, based on Compound interest rate model, a pool utilisation rate of c. 80% will have to be reached to see interest rates on USDC borrowing increase above 5%. Currently there’s a c. 82% utilisation of Compound’s 3.7b USDC pool, and a 6.26% borrow rate - looking at the interest rate curve, however, 80% is an inflection curve and the market should be incentivised to pledge additional USDC and bring rates well below that level. A study of market depth and slippage should be completed to assess Eco’s claim, but we remain interested to know more about what are the company’s existing partnership agreements with those financial institutions.

(5) What is the future for Eco and Eco points? Eco stressed the importance of Eco points without suggesting ways those points could be translated into financial value in the future - especially considering Eco’s target customers might not be interested in participating in distributed governance staking. What is the future for Eco as a company? Does the company also have the intention to transform itself into a DAO? If not, how’s the value of the Eco points linked to the Eco-system growth? Those are all relevant questions the community is trying to answer.

Who Watches the Watchmen

Eco wants to rewire retail banking via capturing customers’ liquidity and connecting directly to liquidity users and services providers. In doing that, Eco aims at reducing the frictions and costs currently incurred at each level of the value chain - while, most importantly, sharing those savings with the participants to the ecosystem. It will be a difficult task, and one that would be successful thanks to the benefits of centralisation.

Ironically, Eco intends to re-engineer a more equal and fair retail banking (although they stay away from the term) within its boundaries, but via leveraging a new set of tools made available by Decentralised Finance. The company insists the project will be financially successful only if users will truly benefit from it - and that should be enough to answer the doubts of the advocates of the decentralisation of roles, responsibilities, and ultimately power, in finance. For those of us that are more curious and skeptical, who like to go deeper on the inner workings, we need more but will keep observing the project as it grows and matures.