Eeny, meeny, miny, moe. Which revenue stream is next to go?

Tweet of the week 🦉🏆

With Robinhood pushing trading costs to $0, a16z’s Rex Salisbury posed an interesting question to see which banking revenue stream might next be attacked by fintechs. Some ideas were net interest margins on cash, corporate B2B payments, trade finance, FX, real estate transaction costs, checking account fees and overdraft fees.

With banks traditional revenue streams coming under threat, revenue will need to be made up elsewhere and it will force incumbents to innovate. It is an interesting thought process to imagine what might be next and how will this be compensated for. Read the article below from John Street Capital on subscriptions for some ideas!

🙋FATP is taking submissions for future Startups of the Week here.

If you enjoy reading this, please subscribe and share! 🙏

Interested in a new challenge for 2021?

Check out ExitUp, a weekly newsletter that delivers a curated list of fresh job openings across PE, VC, strategy/biz ops, finance, marketing, and product management right to your inbox. You'll also get useful insights to help you navigate your job search so that when the time comes, you'll be ready to nail the interview. Subscribe for free today, and find your exit opportunity with ExitUp.

Recent News 📰

🇬🇧 Sifted’s Isabel Woodford speaks with fintech founders on their fintechs to watch in 2021, which includes Scalable Capital, Darwinex, Yapily, Bunq, Codat and Flux.

🇬🇧 The UK dominated Europe’s $9.3bn fintech investment in 2020 with $4.1bn, a drop of 9%. Global fintech investment was $44bn with the US counting for $22bn. UK funding for female-founded fintechs was 17% of the total, up 6%.

🇬🇧 The Bank of England is providing credit and debit card transactions to the Office for National Statistics (ONS) to provide deeper insights about how people spend which could enable more accurate and real-time economic statistics.

Funding 💸

There were 41 deals in the fintech space across the US and Europe with total primary venture investment of ~$400m. Some highlights are below.

🇪🇺 Berlin based Moss raised $25.5m to develop its payment and credit card for SMEs.

🇪🇺 Wealthpilot, a financial data aggregator, raised ~$10m in new money.

🇪🇺 Wealthtech startup Elinvar, backed by Goldman Sachs, has raised $30.5m from Toscafund and existing investors finleap, Ampega and Goldman Sachs.

🇪🇺 Numbrs, the Swiss account aggregation app, raised $30.5m from Saidler Finance.

🇪🇺 Swedish payments firm Trustly is planning a €9bn IPO for 2Q 2020.

🇬🇧 TransferWise has chosen Goldman Sachs and Morgan Stanley for its 2021 IPO.

🇬🇧 Perenna, a fintech bringing “fixed for life mortgages” to the UK has raised a $10m seed round from angel investors.

🇬🇧 Quirk has raised $400k from SFC Capital for its personality focused PFM app.

🇺🇸 Trovata has raised a $20m Series A led by Wells Fargo and also included JPMorgan and Capital One for its automated cash reporting and forecasting solution.

🇺🇸 Brigit announced its $35m Series A from May 2019 which valued the company at $150m.

🇺🇸 Existing Plaid shareholders have been offered a valuation of $15bn, 3x the price Visa was offering, for their shares in the aftermath of the deal collapsing, signalling the valuation they are likely to command in any new financings.

Challenger Banking 🚀

🇺🇸 For the many customers of Simple who will soon be without a bank, you should check out Not So Simple to find alternatives.

🇺🇸 Chime was reported to derive 21% of its revenue from out-of-network ATMs according to Axios. Industry sources dispute the quoted $0.10 ATM interchange fee.

Traditional Banking 🏦

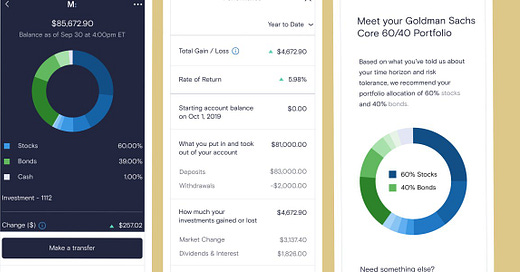

🇬🇧 Goldman Sachs is considering acquisitions to bulk up its UK Marcus savings and lending service as it seeks new customers to unique technology. They also released some screenshots of its new Marcus Invest platform

🇺🇸 JP Morgan has a $12bn tech budget, with $4bn allocated to its Consumer unit, according to an interview with Finledger.

SME Banking

🇬🇧 UK business bank Tide is expanding internationally to India.

Fintech Infrastructure 🚧

🇺🇸 Plaid is looking to focus on the European market given the demands for payment services according to UK Head Keith Grose who spoke with Paige McNamee at Finextra. Plaid is also launching FinRise, an incubator program for Bipoc fintech entrepreneurs.

Payments 💰

🇪🇺 With consolidation in payment processors in Europe, Jefferies highlight Worldline and Nexi as the beneficiaries.

🇬🇧 Consumer watchdog Which? reports 34% of consumers it surveyed were unable to pay with cash at lease once since March, in spite of the governments pledge to protect cash access. This further demonstrates the role of contactless payments in the UK, which accounted for 90% of all eligible transactions.

🇺🇸 Citi has picked Volante Technologies to accelerate its ISO 20022 messaging standard across its global payment operations.

Regulatory Corner 🔎

🇪🇺 Regtech Konsentus acquires Open banking Europe to support banks data sharing initiatives.

🇪🇺 Sweden’s largest banks are collaborating with police to help crack down on money laundering through information sharing.

🙌🏻 FATP Take - With the US passing the Anti-Money Laundering Act 2020, through which US corporations and LLC must disclose “beneficial owners” to FinCEN, AML is set to be a popular trend across the globe in 2020 as governments deal with the financial toll of the pandemic.

🇪🇺 Ireland’s competition watchdog has squashed plans for the country’s four largest banks to create a joint payment app.

🇺🇸 FinCEN has fined Capital One $390m for “egregious” AML failures.

🇺🇸 President Biden has appointed Rohit Chopra head of the CFPB and will lead the charge in what is expected to be a pro-consumer shift for the agency.

Longer reads 📜

Alt goes mainstream - Michael Sidgmore

Square’s CashApp is king - Aika Ussenova

Fifty shades of plaid (part 1) - Matt Ford, Mouro Capital

Monzo founder Tom Blomfield is departing the challenger bank - Steve O’Hear, Tech Crunch

🙌🏻 FATP Take - It seemed that the writing had been on the wall for Tom since May 2020 when he stepped down from CEO to President and resigned from the board. Its been a tough year for everyone and especially for Monzo which recently highlighted how COVID has impacted its business. The European challenger bank space is very competitive and the company has yet to break even. It doesn’t have the business banking side like Starling to rely on nor the abundance of features Revolut has to generate revenue, so has struggled to monetise. Tom speaking honestly about his struggles and mental health challenges are refreshing to hear and comfort to many others going through the same. I would expect some consolidation in the neobank space in Europe and Monzo could be a good acquisition target.

The Neobank bundle & transition to Subscription Revenue - John Street Capital

🙌🏻 FATP Take - Another superb post from John Street Capital which picks up on the growing trend of neobanks to shift from interchange revenue to subscription revenue. The world is moving to subscription so why not banking. Whilst paying for a bank account is more common in the US, consumers pay an average of $7.69 per month (Bankrate), in the UK this is far less common. Banks make more money through cross-selling, which makes paying for something that Brit’s perceive as free quite challenging. Monzo has seen only a 2% conversion whilst data for those paying for Revolut haven’t been made public, indicating a possible lack of success. A great write up on Monzo vs Revolut’s battle for paying subscribers here (via Aisling Finn, Altfi.com). Adding valuable services, i.e. rebundling, seems to be the only option for neobanks in Europe to get to profitability in smaller markets and I see brokerage, lending, liability optimisation, rewards and insurance being key additions in the space.

The 5 hottest technologies in Banking for 20201 - Ron Shevlin, Forbes

The private equity firm’s private equity firm - Marc Rubinstein

Deciens Capital’s Dan Kimerling on Seed Funding and Emerging Fintech - Finovate

'Atomic Habits' Author James Clear: 'I'm Never Far From a Good Idea' - Polina Marinova

Your feedback is a 🎁, please give below 🙏

Follow me on LinkedIn and Twitter.

Michael