FATP Special Edition - Users are goal oriented not detail oriented.

A solution combining self-driving money and personal financial management.

History Lesson

Personal financial management has been around for a long time, before “fintech” became a thing. Scott Cook and Tom Proulx created Intuit in 1983 and Microsoft launched their own PFM service, Microsoft Money in 1990. Both parties later teamed up to create Open Financial Exchange, a platform allowing the exchange of financial information, (OFX) in 1997 which was a precursor to Plaid.

And if you thought that open banking was the genesis of account aggregation, you are wrong. Yodlee, founded in 1999 eventually pivoted to financial services and allowed users to view all of their different financial accounts at once.

One of the reasons that personal financial management, whilst having been around for a long time, has yet to take off in a big way, is that it is still too complicated and cumbersome. With the technology that we have, we can do better. Personal finances have become more transparent as we have migrated from paper and Excel solutions to apps such as Mint but you cannot easily act upon these insights.

An interesting ecosystem within personal fianncial management is emerging which automates these activities. Much like the promise of autopilot on autonomous vehicles, self-driving money could allow our finances to manage themselves with minimal user action and be the innovation that is needed to expand the user base for PFM.

Self-driving money is a tool through which personal financial management will finally be suitable for everyone. But to get mass appeal, it has to be goal orientated. No-one has a goal to earn an annual return of 3.5% on their retirement savings for 20 years. But you might have a goal of having $1.5m in retirement savings by age 65 or more likely a goal of having an annual retirement income of say $40,000. PFMs need to think in terms of users goals and not be detailed orientated.

Different stages of self-driving money

Source: Alex Johnson

Alex Johnson has done an excellent job in his recent post “Why Self-Driving Money is so hard” of outlining the different steps and the different stages are outlined above so I won’t rehash them. I did however want to flesh out my utopian idea.

My utopian state combines both level 5 self-driving money and personal financial management and is enabled by a fictional startup I have called Union which sits at the center in the above illustration. Much like PFM apps already do, Union aggregates users different financial accounts and products in one app. Union connects via APIs to these accounts and pulls data from them (balances, transactions etc) but in this scenario, data flows both ways. Flowing downstream to these accounts are automated payments and money transfers enabled by the rules and goals set by the user. There are fully autonomous options in which rules and goals are set and Union does its thing with no input from the user as well as semi-autonomous options where permission can be given with the click of a notification to agree with an action.

An interesting additional feature would be that when you spend money on your debit card which is connected to Union, if this reduces the amount in the account ringfenced for necessary expenses, Union could notify you and ask where you wanted to fund the purchase from. Possibly it comes out of your savings or maybe you liquidate an investment. Fintechs are working on this automated liquidation of investments which is exciting.

Why would a user sign up?

As well as aggregating the accounts that a user has, Union would also have third-party financial services suppliers on their platform. These suppliers would join the platform in order to acquire new users. From the supplier’s perspective, this would be a dramatic change in business model. It would add a B2B2C channel to their traditional B2C which requires a different skills but they would still have a direct relationship with the end user and not be disintermediated to a great extent. This change of business model for suppliers is a big challenge to the whole concept and I will address this later in this post.

The switching of accounts could seamlessly be facilitated by Union through a digital account opening processes. Union would already know your personal details and SSN so could go through the customer onboarding process itself with users permission. This would improve the drop off rate as a technology solution would not get sidetracked or lose interest in completing the application. I am cogniscent of the regulatory and legal challenges for this but I think this still could work.

Union would aggregate different providers on their platform in order to provide the best products for its users. If a student loan company that the user isn’t a customer of has a product that is cheaper than their current provider, Union would know this and enable them to switch seamlessly, automated with user permission, to save money or to extend the loan period to make it more affordable each month.

Services that are similar to this are available in the UK. USwitch is a price comparison and switching service that allows customers to compare prices for utilities, internet and mobile services but to also use the site to switch to alternative providers easily. Lookaftermybills.com is another similar service that switches your utilities every year to the cheapest provider. These types of automated switching services are becoming more popular as customers are tired of being ripped off by big companies. Monzo, a challenger bank also in the UK has embedded the ability to switch energy supplier in its app. This should be table steaks for providing value

Meet Joe

Joe is a fictional user of the fictional startup Union and I will use Joe to illustrate the user perspective. Joe is a busy guy, trying to balance everything that is going on in his life and he doesn’t have time to spend researching online and learning about different financial products and how they might work for him. He does however, like all of us, have goals in his life that he would like to achieve. Joe’s goals include;

Pay off student loans as quickly as possible

Save $2,500 for annual vacation

Save $30,000 for a future wedding in eight to ten years

Save $50,000 for a college fund in the next twenty years

These goals would guide everything that Union does for Joe. He would connect all of his bank accounts, savings accounts, investment accounts, student loans, credit cards to Union to better manage his finances in accordance with these goals.

When Joe is paid his $4,000 monthly salary (this would also work with variable salary schedules), Union ringfences the $2,000 it determins that Joe spends on bills and essentials such as food, utilities and rent. These insights come from intelligently analysing the transactions from his checking account and credit cards.

Union has seen that Joe’s regular student loan payment is $400 but his top goal is to pay it off as quickly as possible and it would prompt Joe that it recommends increasing his loan payments to $600 per month in order to reduce the payback time on his loan from 8 years to 5 years. Joe would agree and Union would handle the increased payments flowing down to his student loan company. Union could suggest some insights of where he might want to trim his expenses to help offset the increased payment.

Union would save the remaining $1,400 of Joe’s salary based on his risk appetite and the time horizon of his goals. Given Joe’s second goal is to save for his annual vacation, it would save $210 in a low risk savings account or CD but his longer term goals would be transferred into an investment account that met his risk appetite and other goals. Union would forecast Joe’s likelihood of reaching his goals based on his saving rates for each goal and the expected return on his money in each respective account. These projections would allow Joe to see how likely he is to meet his goals and either make changes to his goals if they are not attainable, or have Union suggest ways he could meet them.

Retirement planning could also feature in this as Union could pull in his employers pension plan details and project Joe’s retirement account balance at his desired retirement age. Making sure that Joe was taking advantage of all tax benefits and loss harvesting could also feature in Union to get Joe as many benefits as he is entitled to, some of which are not well known.

All of this happens in the background each month because Joe has set up his goals upfront. Union has to be goal based as one of the challenges people have when it comes to manage their money is that they don’t think or don’t know if 4% return is good or not. They think that they want to be able to retire with a decent pension pot. They are goal orientated and not detail orientated. Joe can either set Union to automate everything or that he has to click to approve transfers each month which would give him more control with little additional work.

Union

Union would ensure that Joe’s money works for him and prompt him when it finds a better refinancing deal for his student loan because his credit score has increased or there is a higher yielding CD or savings account for him. If there are cheaper credit cards or better investment accounts with partners, Union would tell Joe and ask if he wants to switch.

Given the commoditisation of financial services, users like Joe only care about the user experience as everything in the background is ultimately only a digital ledger entry and protected by FDIC for most people.

Union’s business model would be that it would acquire users with a great user experience and a value proposition of increasing wealth by having your money work for you and not someone else. Professional financial advice and money management is something not available for everyone but Union could help to democratise that. Rather than having large balances sitting in your checking account, Union would sweep them into a higher yielding savings account or investment product, earning a return. Union would also know when bonus rates end and always be on the look out for better products to maximise the return your money earns. This is the value to consumers.

Just to demonstrate the value further, BankRate found in 2019 that 69% of Americans were earning less than 2% on their savings, despite wide availability of online savings accounts paying 2%+. There are over 200m adult Americans and with the average savings balance of just under $9,000 according to the Federal Reserve combined with the missing interest (0.6% market leading rate as per NerdWallet minus the 0.05% average savings rate per FDIC), there is a potential of $99bn in interest being left on the table. Every year.

The time taken to build the platform would no doubt be costly and it would certainly be possible to charge users a monthly fee for using the many services as some PFM apps have done. Digit for example charges $5 per month for its services. For Union to gain traction I believe it would have to have some core functionality offered for free, with premium services charged for per month. Account aggregation, account switching, automated money transfers and goals might be free but for advanced insights, forcasting/projecting of goal achievability might be considered premium and have a fee associated. The value a user gets from Union for free must be enough to entice them and the balance of features will require testing. Union would also get an affiliate fee when a partner acquires a user. This is a tried and tested business model used in financial services

Third-party suppliers will join the platform because of the potential to add new users and grow. With digital account opening increasing the top of funnel conversion, Union would lower the cost of acquisition for a supplier. Whilst churn might increase as your customers could easily switch to another provider, it would force suppliers to be on their game and constantly offer a compelling product. This however still might not be enough though.

Challenges

Whilst this scenarios appears idealic, there are many challenges. PFM apps currently do not have good models to categorise data. Especially in Europe where there are regulated standards which allow only a set number of characters in the description and merchant fields, this can be challenging. This data is pretty necessary for a lot of the underlying functionality of Union so it is a big challenge. There is potential that without forced regulation in the US a private company can get richer data on transactions but this is by no means guaranteed.

Enticing suppliers of financial services to the Union platform may also be challenging. Banks are increasingly concerned with being disintermediated and commoditised, losing the valuable customer relationship, so they might see that Union would be the primary way a user would interact with their product and they lack direct control and engagement. If a user manages his money through Union, there would be less engagement with the suppliers own app/website and generally less engagement with their brand because Union sits in between them. Whilst major banks with big brands might not want to do this, there are plenty of smaller banks, credit unions and community banks that want to grow and likely would sign up if there are enough users on the platform for them to potentially see large deposit growth. However because Union looks out for the customers interest and will switch customers accounts, it may increase churn for a supplier and not be an attractive propositon. If the supplier has a superior product, it may like the additional distribution channel.

As mentioned before, monetisation from the user could be challenging. In a world where PFM apps are designed to save money, asking for a user to pay before they get the benefit of the service is something that could be difficult to sell. A guarantee of an amount to be saved or additional return generated or your money back would be a possible solution. The PFM space is quite small because there aren’t that many people that take an active interest in their financial lives for a myriad of reasons. Most common are the complexity and abundance of options available. Historically PFMs have failed to make money because they didnt provide enough value to users to get them to pay. PFMs in their current state require users to still do a lot of work themselves with any insights or transparency they generate. Self-driving money would do this for them and that would be the value to the user, which they would be willing to pay for. Union would need to make the product simple, easy to understand and weave financial education throughout to increase user comfort. By being goal orientated is essential and should be at the heart of the solution.

Because this is a two sided market place, it could face the chicken and egg problem. Users will only be interested if there is a lot of value to be had which means Union would need to sign up a few suppliers with attractive products. I believe Union could start with user acquisition and do a lot of the work manually whilst it scales before building out increased automation and onboarding of users.

Credit Karma presentation MoneyConf 2018

For instance, Credit Karma found the above mispricing exists for auto loans in 2017 showing clear inefficiencies and a lack of information for borrowers. An early version of Union could manually compare the cost of the current auto loan a user has with a bunch of other providers to see if they can get a cheaper deal.

The impartiality of Union will also be a challenge. With partners on the platform as a key monetisation strategy, Union will need to ensure that customers come first and that it doesn’t recommend any products in which it earns a fee without there being a customer benefit. Also, how Union would manage a situation where the best deal for a customer wasn’t through a partner on the platform would also be a challenge.

Who can build this?

For the solution to be open and integrated, the incentives don’t work for established players like Wealthfront. It also goes without saying that this will have to be built in stages and I think Astra is the closest. It is already consumer facing and building out the infrastructure piece so has a lot of potential. If they were to partner with a PFM app or start build out the customer facing portion themselves, that would be the most logical next steps.

Companies that are market leaders or in the top tier of providers will create roadblocks for something like Union to exist because it will cannibalise their existing businesses by allowing money to easily be moved off the platform. But there are a number of high quality less known financial services companies out there that are looking for ways to accelerate growth and with a better product, partnering with a company like Union could be a solution.

To Summarise

Research shows that money is the dominant source of stress for 44% of Americans. This was nearly double the next source. Personal finances are confusing, it can be boring and it is often depressing and emotional. But it doesn’t have to be.

Self-driving money holds the key to solving many of these issues with personal financial management. With time and resources, I think the data problem can be solved. The biggest hurdle is enticing suppliers to the platform and the changing of their business model from a B2C to a more B2B2C play. To be clear, you won’t see a JPMorgan or a Citi on the platform because they have the brand name themselves already.

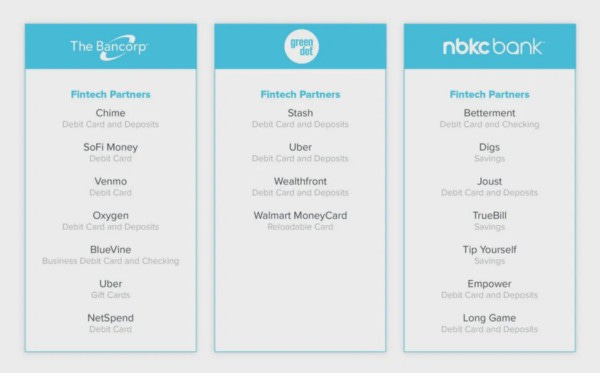

Source: a16z

However the lesser-known institutions who don’t have an established brand or a wide distribution channel might be interested. These types of institutions offer similar products to established players and have already shown willingness to embrace fintechs. In the image above a16z has noted the boom in partner banks who provide the underlying financial products for many of the popular fintech apps already so the model is there.

According to NerdWallet, these are the highest yielding online savings accounts. There are really only three recognisable names on the list, American Express, HSBC and Barclays. The other banks are less known and unless you searched online on sites like NerdWallet, you wouldnt know about them. It is institutions like these that will want to partner with Union.

On the pricing side I think there are enough features for Union to be able to have a free tier that still provided enough value to attract users. Clear demonstration of value in terms of dollars saved and gained is crucial and monetisation can come from both selling premium features which derive additional value as well as the affiliate model. By weaving digestable financial education in an engaging way, users financial literacy will also increase.

Personal financial management is hard because it is inherently “personal”. There is no one size fits all and everyone has a somewhat different need. But I believe the vast majority of use cases can be covered with one app with enough flexibility which can begin to get users in a better financial situation.

The Financial Health Network found that 7 in 10 Americans strugged with at least one aspect of financial stability. The destructive impact of COVID has compounded this already sorry state of personal finances for many Americans. Another recent survey showed that 54% of Americans face serious financial hardship and bankruptcy due to COVID.

Self-driving money combined with personal financial management could help users understand personal finances and support them with their goals in life. A company like Union could put the personal back into personal finance.

If you enjoyed this special edition, please subscribe so you don’t miss any in the future!

I welcome any feedback and comments on the above and would love to discuss further with anyone interested so please reach out!

"I welcome any feedback and comments on the above and would love to discuss further with anyone interested so please reach out!" Thanks for that opportunity.

I don’t think Union, the super PFM app, for their business model, should or will be partnering with any provider. That’s a wrong assumption imho. Consequently, in Union, level1, 2 & 3 in Union also don’t exist.

And about Alex Johnson who says

Self-Driving Money is So Hard Hint: it's not a technology problem.

I think it actually is a technology problem. What else could it be? And as a matter of fact, all parts needed to build Union appear to already exist today. It’s just currently all the pieces form a giant disorder of a systemic puzzle.

By removing some assumptions and reordering the pieces, it’s possible to build Union.

Ultimately his conclusion is incorrect since based on another wrong assumption :

"it means cannibalizing your existing business".

Self driving is cool but it’s like the last 1% of the work that will need to be done. We still have to build the first 99%.

It’s like auto parking for cars. For the 1st gen you had to use the break pedal to control the speed or you had to change gears for it. Not anymore on the 2nd gen. So from a technological point of view, the giant leap wasn’t from gen1 to gen2, but from gen0 to gen1. Once gen1 was built, gen2 wasn’t really that hard.

It’s the same thing for Union. We haven’t built gen1 yet. But when we do, Union gen1 will actually be more life changing (literally) than Union gen2 aka level5* will.

It’s not the self driving money itself that will give us the wow factor . It’s the little features to get there that will. Aka Union gen1 features.

So imo, what’s currently missing is a PFM that tells us how to drive. Then one day, it will drive for us.

And I don’t think the value graph of Alex Johnson can be applied to self driving money. The self driving level5 has a lot of value for the user and actually probably even more positive externalities we haven’t even scratched yet.

But the way I see it for the money is Union gen1 is groundbreaking, gen2 is cool because it works for me. You won’t get more raw value from Union when gen2 is shipped. You will "just" loose less time since you won’t be driving.

"Enticing suppliers of financial services to the Union platform may also be challenging." Union gen1 won’t need their agreement to have them on its platform. But Union gen2 will have to.

* If Union is built providers agnostic from the ground up, there aren’t 5levels to get to self-driving money.

What’s your thoughts on this ? I too welcome any feedback and comments on the above !