Goldman Sachs - masstige or miss?

Quick FATP Update

FATP is back with a bang after a two week break over the holidays.

In 2021 I will be experimenting with FATP content and format with the first experiment being to split out my Startup of the Week (SotW) posts which have become longer into a separate issue, probably going on Thursdays. An awesome UK fintech to kick off the year!

🚨 SoTW submissions 🚨 - I am looking to connect with more founders and am taking submissions for future SotW issues here!

Tweet of the week 🦉🏆

2021 is off to a roaring start already.₿ hitting all time highs over $35k. Terrorists entered the US Capitol after encouragement from President Trump. 🇬🇧 finally left 🇪🇺 . Jack Ma is MIA. Cancel culture got one of the original neobanks, Simple, which is being shut by BBVA.

With the news that Goldman is launching a mass market investment product, Marcus Invest, the company could be facing its hardest challenge to date: maintaining its upmarket branding whilst having mass-market products. The pursuit of a combined mass market and prestige or “masstige” brand imagine is fairly illusive and there is a long list of brands who have moved down market and failed. Italian fashion designer Roberto Cavalli knows this too well, perhaps he could offer some advice.

If you enjoy reading this, please subscribe and share! 🙏

2021 Predictions 🔮

Below are links to a few of my favourite fintech predictions for 2021;

a16Z - disintermediating the banking system, embedded insurance, product-led social+ fintechs, alternative assets, an expanded fintech community, new distribution channels.

Lightspeed’s Natalie Luu - enterprise adoption of white-label payments infrastructure, CFOs tools for real-time decision making, rise of global fintech infrastructure companies.

Jason Mikula - challenger bank exits US market, Apple + Goldman enter BNPL space, fintech buys a small bank for a charter, governments leverage fintech’s for benefit disbursements.

Jay Ganatra, PayPal Ventures - impact of increased data availability, new distribution channels reducing cost.

Ashley Paston, Bain Capital Ventures - continuation of embedded finance, acceleration of insurance innovation.

Mark Goldberg, Index Ventures - new distribution channels, rise of social and collaborative fintech.

Jimmy Zhu, Citi Ventures - increase financial support and offerings from employers.

Recent News 📰

🇺🇸 Forbes announced its inaugural Fintech Awards which went to; Best Product = Chime, Most Intriguing Newcomer = HMBradley, Disruptive Innovator = Affirm, Outstanding Firm = Propel.

Funding 💸

*Select funding rounds from late December to today only in this issue

🇪🇺 German banking infrastructure vendor Mambu raised €110m at a €1.7bn valuation joining the 🦄 club. Investors include Tiger Global, Bessemer, Runa, TCV and Acton.

🇪🇺 French core banking vendor TagPay raised €25m from Long Arc Capital.

🇪🇺 Pennylane raised $18.4m in funding for its SME accounting tool solution from Global Founders Capital and Partech Partners.

🇬🇧 Trading platform eToro is planning a $5bn US IPO.

🇬🇧 Banking technology firm 10x Future Technologies is looking to raise a $100m Series C.

🇬🇧 Agricultural challenger bank Oxbury raised £15m as it prepares to launch and is backed by the Duke of Westminster.

🇺🇸 Payroll infrastructure player Atomic FI raised $7m in convertible debt from undisclosed investors in December.

🇺🇸 Bolt raised $75m in late December in a Series C led by General Atlantic and included Tribe Capital.

🇺🇸 Perch, a credit building solution, raised a $2.5m seed round from Citigroup, General Catalyst, PayPay Ventures, Sequoia, Village Global and Softbank.

🇺🇸 SoFi is going public via Chamath Palihapitiya’s $IPOE$ SPAC, valuing the company at $8.65bn. Check out a great breakdown of their deck here h/t Jason Mikula.

🇺🇸 Travel BNPL provider UpLift raised $68m in debt financing from Atalaya Capital.

🇺🇸 Challenger bank Oxygen has raised $17m in a Series A round from new investors and existing investor Rucker Park.

🇺🇸 Expense tracking firm Divvy raised $165m at a $1.6bn valuation from investors including Acrew Capital, Insight, NEA and PayPal.

Challenger Banking 🚀

🇪🇺 Orange Bank has acquired French neobank Anytime as it expands to serve contract workers and SMEs.

🇬🇧 Revolut is applying for its British banking license, aiming at becoming a primary account for its customers.

🇺🇸 Green Dot, the financial technology and bank financial products from Walmart, Apple, TurboTax, Uber Amazon and Gig Wage, has launched its own challenger bank GO2Bank, targeting Americans living paycheck to paycheck. Looks like Green Dot has Chime in its crosshairs 🎯.

🇺🇸 Square is reportedly considering buying Jay-Z’s Tidal music streaming service.

🙌🏻 FATP Take - Although the acquisition seems to come out of left field, Square’s Cash App and Tidal likely have a good amount of crossover in target users and Tidal could help Square build out a super-app to keep younger users engaged and using the Cash App. Looking forward to future Cash App Friday giveaways and merch if this happens!

🇺🇸 Venmo has introduced a feature to allow customers to cash paper checks in its app and is initially waiving fees to help recipients of the stimulus checks. Future fees will be 1% (min $5 fee) on government and payroll checks with pre-printed signature and 5% (min $5 fee) for hand-signed.

🙌🏻 FATP Take - Whilst a very beneficial service, especially given the new round of stimulus checks, the fees seem very high. Check cashing fees range from 1%-12% in the US but are typically 5% or less. Some California businesses charge 12% for personal checks. UK banks on the other hand mostly offer the check cashing services for free. This seems like a revenue grab for Venmo and a case of short-termism. Challenger banks are in a race to the bottom when it comes to fees, zero fee overdrafts are fairly common, and it is likely eventually fees for cashing checks comes right down.

Traditional Banking 🏦

🇪🇺 ING Belgium is partnering with Minna Technologies to launch a new digital banking service that allows customers to manage their subscriptions without leaving the bank’s digital channel.

🇺🇸 Goldman Sachs is launching Marcus Invest, a robo advisor for the mass market

🙌🏻 FATP Take - Marcus Invest represents a continuation of Goldman’s strategy, beginning in 2008, of moving down market from its private bank and high net worth clients to mass market consumers. Since its 2016 launch, Marcus has grown into a near full-service consumer bank with lending, savings, PFM and soon to be investments. Goldman is well positioned to cross-sell its mutual funds and ETFs and leverage the increasing interest among consumers in alternative assets. A key thing to watch is the Goldman brand and how it changes with a move downstream.

Fintech Infrastructure 🚧

🇺🇸 In late December Finicity signed a data agreement with Brex, allowing the corporate credit card startup’s customers to link their accounts to apps using Finicity’s data network.

🇺🇸 Identity management platform Jumio sees digital health credentials to show proof of a COVID vaccination as a gateway to digital IDs according to Pymnts.com.

Payments 💰

🇪🇺 Klarna was raked over hot coals by the UK Advertising Standard Authority over an Instagram influencer campaign that encouraged spending “to boost their mood”.

🙌🏻 FATP Take - BNPL companies have to tread very carefully with encouraging consumer spending given previous issues with payday lenders.

🇬🇧 Brits face a £2.3bn BNPL bill from their Christmas shopping according to Credit Karma. With an average bill of £170 and half of under 35s relying on the method, BNPL’s status as unregulated could come to an end in 2021.

🇺🇸 New York’s MTA has completed its rollout of contactless payments in subway stations a mere 17 years after the introduction of the contactless payment Oyster card in London.

Regulatory Corner 🔎

🇬🇧 HSBC is partnering with Silent Eight to help it fight financial crime, which is expected to be a focal point for large banks in 2021.

🇺🇸 PNC is suing Plaid for trademark counterfeiting, trademark infringement, false advertising and wrongdoing for using PNC name and logo in Plaid apps.

🙌🏻 FATP Take - The lawsuit comes at a tough time for Plaid when its acquisition by Visa is coming up for trial. A lot of banks will be watching the outcome of this lawsuit and will be ready to file their own if PNC are successful.

🇺🇸 PayPal scored a victory against the CFPB overstepping its authority with regards to requiring fee disclosures on prepaid cards and digital wallets.

🇺🇸 10% of the $360bn CARES Act unemployment benefits were fraudulently claimed due to the pressure to pay money out quickly.

🙌🏻 FATP Take - The government will likely face similar claims levels of fraud in the new stimulus program. Although no system is immune from fraud, there is a lot that can be done to help mitigate this in the future. Fintech’s are waiting to help with KYC, identity verification and disbursements. The government needs to change its approach and work with fintechs like Propel who are innovating in the benefits space but they seem too focused on making it as difficult as possible to claim benefits people are eligible for.

Longer reads 📜

10 Thoughts as 2020 Comes to an End - John Street Capital

Your credit score should be based on your web history - Gizmodo

🙌🏻 FATP Take - Alternative data is a big market which could see consumers who were previously denied credit under traditional credit underwriting, have access with the incorporation of additional data. This data MUST have a demonstrated impact of creditworthiness. Two things matter with credit, ability to pay and willingness to pay. Traditional models are good at assessing ability, maybe alternative data can help with willingness.

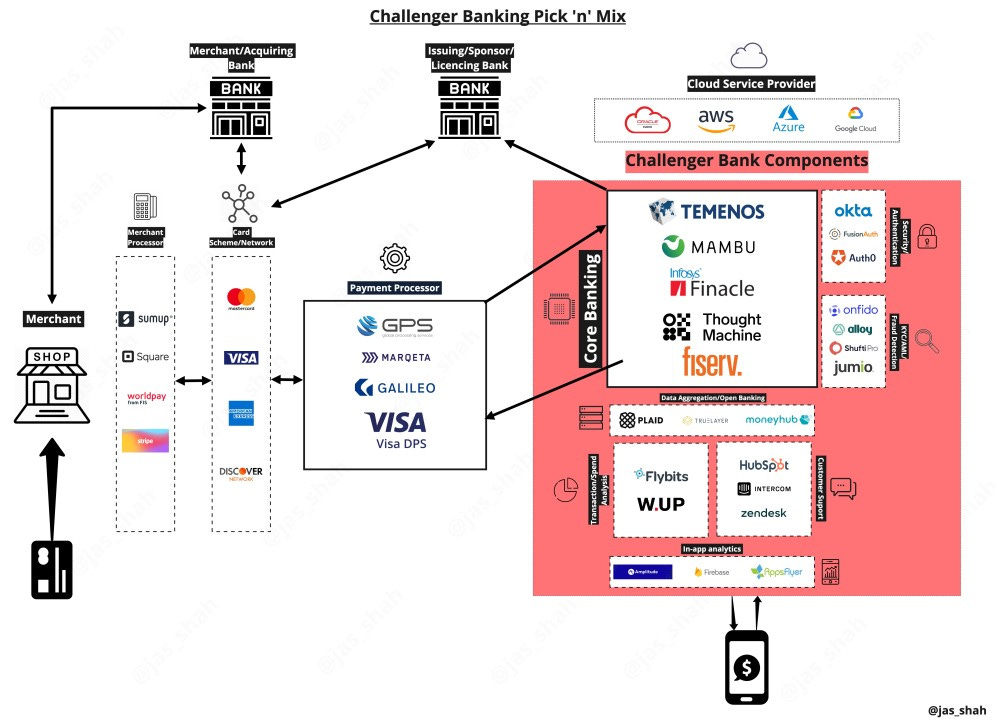

Under the hood: The Merchant Payment Process - Jas Shah

🙌🏻 FATP Take - Jas has put together a visual masterclass for payment beginners. Highly recommend reading it to understand what happens when you make a payment and who is involved.

David Blumberg talks fintech, remote work and his move to Miami - Finledger

How Chime Is Dominating Digital Banking - Ron Shevlin

Goldman Readies Mass Market Roboadvisor - Jason Mikula

Fifty shades of Plaid - Part 1 - Matt Ford, Mouro Capital

Wealthtechs lead the way with automated cash management - John Egan, Finledger

🙌🏻 FATP Take - This is the next phase of self-driving money and Finledger have a great breakdown of Betterment’s “Two-Way Sweep”, Wealthfront’s “Autopilot” and M1’s “Smart Transfers”. All three facilitate the movement of spare cash into other accounts in their closed ecosystems. I believe the future will be for a provider to do this with any of a consumer’s accounts, not just ones in a closed ecosystem. The future is open.

Your feedback is a 🎁, please give below 🙏

Follow me on LinkedIn and Twitter.

Michael