Team Monzo or Team Starling?

Tweet of the week 🦉 from Nik Milanovic

A IPO is never an easy process but Jack Ma had an extremely difficult week in which the IPO of Ant Financial, which was set to be the world’s biggest IPO, was suspended by Shanghai Stock Exchange. Jack’s recent speech with disparaging remarks about the Chinese banking system didn’t go down well with China and he faced the consequences.

If you enjoy reading this, please subscribe and share! 🙏

Recent News 📰

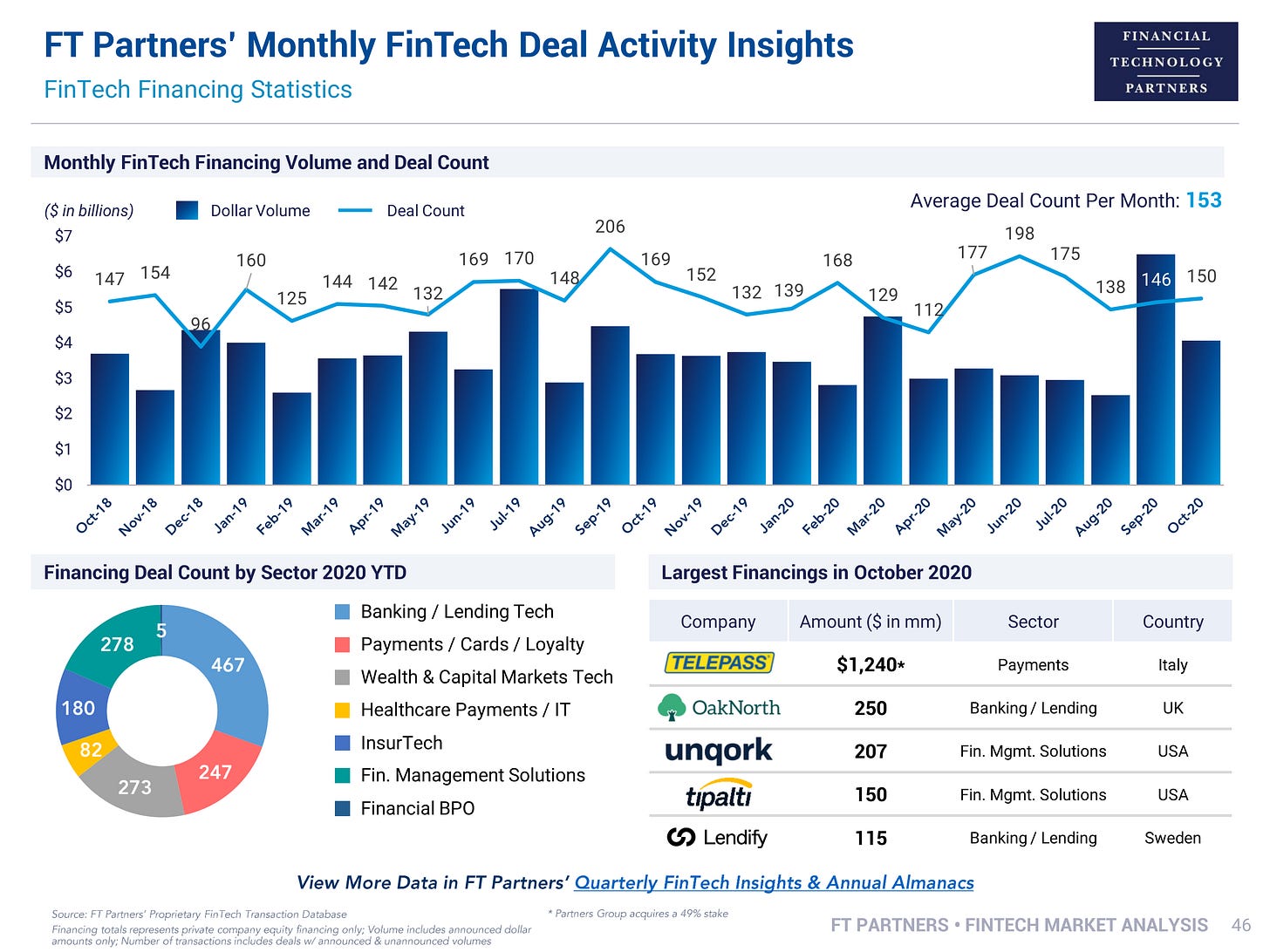

🇺🇸 Fintech banking powerhouse FT Partners released its monthly update with some notable highlights;

An large increase forecast 2021 PE multiples of fintechs in the lending/mortgage space but mostly decreases in other sectors, most notably in payments space, potentially from fall out of Visa/MasterCard regulatory scrutiny.

US fintech IPOs will be the highest since 2017 in 2020 with 19 YTD.

Funding 💸

🇪🇺 Vivid Money, a German challenger bank, has raised €15m in a Series A from Ribbit Capital.

🇬🇧 Sugar raised $2m from Passion Capital to help finance game studios with loans rather than equity funding.

🙌🏻 FATP Take - This could be the start of lending verticalisation as we have seen similar trends in consumer banking.

🇺🇸 Upstart, the digital lending platform, has filed for an IPO. Pricing not announced.

🇺🇸 Commercial loan platform Blooma raised an undisclosed amount from Nyca Partners.

🇺🇸 Fast, an online checkout solution, is rumoured to be raising money at a $1bn valuation, only one year after its seed round valued it at $11.5m. The company is however backed by Stripe.

Challenger Banking 🚀

🇬🇧 The UK challenger bank space split into Team Monzo vs Team Starling the past week after Starling Bank founder Anne Boden released a book detailing the founding journey of Starling but also the early days when former CTO Tom Blomfield left to start Monzo.

🇺🇸 Trouble at Beam Financial, the consumer high-interest bank account startup. Customers reported issues withdrawing funds and there was confusion over who is to blame as Beam relies on a number of third party vendors and accusations of fraud and mismanagement. A wake up call for the industry especially and regulators, especially given the recent Wirecard saga in Europe.

🙌🏻 FATP Take - Regulators are increasingly likely to take a closer look at fintechs which operate outside of their purview, whether that turns into direct regulation or forcing their regulated partners to do more rigorous diligence, that remains to be seen.

🇺🇸 Guideline is rumoured to be closing an investment from American Express, as per Finledger. Guideline helps SMBs adopt 401(k)s through automation of admin, record-keeping and back office processes.

Traditional Banking 🏦

🇪🇺 BBVA is teaming up with Anthemis to create a London fintech startup studio.

🇬🇧 TSB, the spin off from Lloyds TSB, is partnering with Wealthify to build a robo-advisor for customers

🙌🏻 FATP Take - TSB has a horrid track record with IT so its great to see them partnering with a fintech to bring a new product to market. I see more partnerships like these in the future for banks who will fall back to their core competencies, which is not tech/product.

🇬🇧 HSBC is to launch a rival to Transferwise in a similar move to Santander which launched PagoFX earlier this year.

Fintech Infrastructure 🚧

🇪🇺 BBVA is moving its market data network to AWS, which will provide more scale for handling huge volumes of data.

🇺🇸 The Dodd-Frank act ensures consumers have a right to their data but banks do not always play nice. Data aggregators like Plaid and Yodlee are stuck in the middle. Now the CFPB gave advanced notice of proposed rulemaking (ANPR) to flesh out the scope of data access rights in Dodd-Frank. Comments on it are due within three months.

Payments 💰

🇬🇧 Built For Mars has done a very detailed breakdown of the UX experience for POS services from iZettle, Square, Sumup ad Verifone. Another excellent read from Built For Mars.

🇬🇧 Previous Startup of the Week Zilch is teaming up with Credit Kudos to power its credit affordability engine. Credit Kudos also put out a report on trends in alternative lending data.

🇺🇸 Square reported strong earnings that saw its share price 10% in early trading and near all-time highs. Cash App was a key driver of the results with $385m gross profits for Q3.

🇺🇸 PayPal also reported earnings with shares underperforming due to Q4 outlook. TPV was $247bn, just ahead of expectations, with Venmo making up $44bn and $900m in revenue expected in 2021. PayPal is also looking to integrate its BNPL service with Venmo.

🇺🇸 A nice summary of Apple’s fintech exploits with Apple Card, Apple Cash and Apple Pay to date from the team at Finledger.

🇺🇸 With the news that the DOJ was filing an antitrust lawsuit to prevent Visa acquiring Plaid due to its monopoly on debit transactions, I thought this would be a slam dunk as Visa is clearly a monopoly. However, upon further inspection the case is not that clear. It sounds like Plaid may have been building an A2A payment rival.

🙌🏻 FATP Take - The Durbin amendment ensures that debit transactions have at least two unaffiliated network choices on every card, to provide some competition to debit networks. Prior to this 40%-50% of all debits cards only had one routing network available and 79% of Visa debit volume at the top 10 banks ran on cards with no other debit network routing options. Still confused? Read more here.

🇺🇸 American Banker reports that demand for real-time payments (RPT) is high among small banks for different reasons.

Regulatory Corner 🔎

🇬🇧 Interesting chart above from Plaid on the spread of open banking across the globe.

Longer reads 📜

Check out Simon Taylor’s recent newsletter for dive into core banking transformations.

Deep Dive: “Fintech” vs. Traditional Lender Analysis - Jason Mikula

Banking the Karma Army - Paul Loberman

Inside Cash App Friday - Julia Glum, Money.com

Startups of the Week ⭐🇺🇸🇬🇧🇪🇺

You can check out last month’s featured startups here.

🙋 If you are working on any exciting fintech startups, I would love to connect with you so drop me a message.

🇪🇺 Loanitt is a financing platform out of Ireland which recently added a car financing solution. The auto-financing market is huge and expected to grow to $344bn by 2026. A lot of car financing is done by financial services arms of manufacturers at the time of purchase and aren’t always the best rates available. Loanit is trying to inject some competition into the market with personalised offers from a panel of lenders.

Started by John Duggan and Padraig Nolan in 2019 and both have a background in computational finance and risk. Loanit has raised $670k to date from Enterprise Ireland and Halo Business Angel Network. John was a finalist in Ireland’s Best Young Entrepreneur competition.

🇪🇺 Startup Includer is a tool for investor groups to manage deal flow and events. Think of it like Angellist but with more features specifically for managing information flow for a group of investors.

Seren Rumjancevs started the company in 2017 and has raised an undisclosed angel round from Contriber Ventures.

🇺🇸 Pipe is part of a new breed of alternative ways to finance a business. For companies with recurring revenues, especially SaaS companies, Pipe will facilitate the selling of those revenues to investors to raise funding without dilution. It creates an asset class from recurring revenues.

John Street Capital has an excellent breakdown of this emerging space as does Not Boring’s Packy McCormick.

CEO Harry Hurst raised a $66m seed from investors including Anthemis, Craft Venture, Fin Venture Capital and Tribe Capital.

Your feedback is a 🎁, please give below 🙏

Follow me on LinkedIn and Twitter.

Michael