The $8.7bn crossover bid for fintech.

This week has seen lots of news featuring smartphone monetisation platform funnels cost-effective neo-customer analytics ledger performance paradigm. If you made sense of that, well done. You should quit your job and become a fintech marketer. Or contribute to fintech ipsum, the source of an incoherent sentence of jargon.

In a week of highs and lows for fintech, we saw the Plaid/Visa deal fall apart, by all acounts Plaid pulled the plug due to the valuation it got. Most opinions see this as good for Plaid and the ecosystem and negative for Visa. Payments expert Tom Noyes was noticeably contrarian and had this as positive for Visa. The high was the announcing of 4 $300m+ rounds in a week where fundraising exceeded $5bn. It was very interesting to note these large rounds were led largely by crossover investors, a name given to investors who invest in both public and private markets.

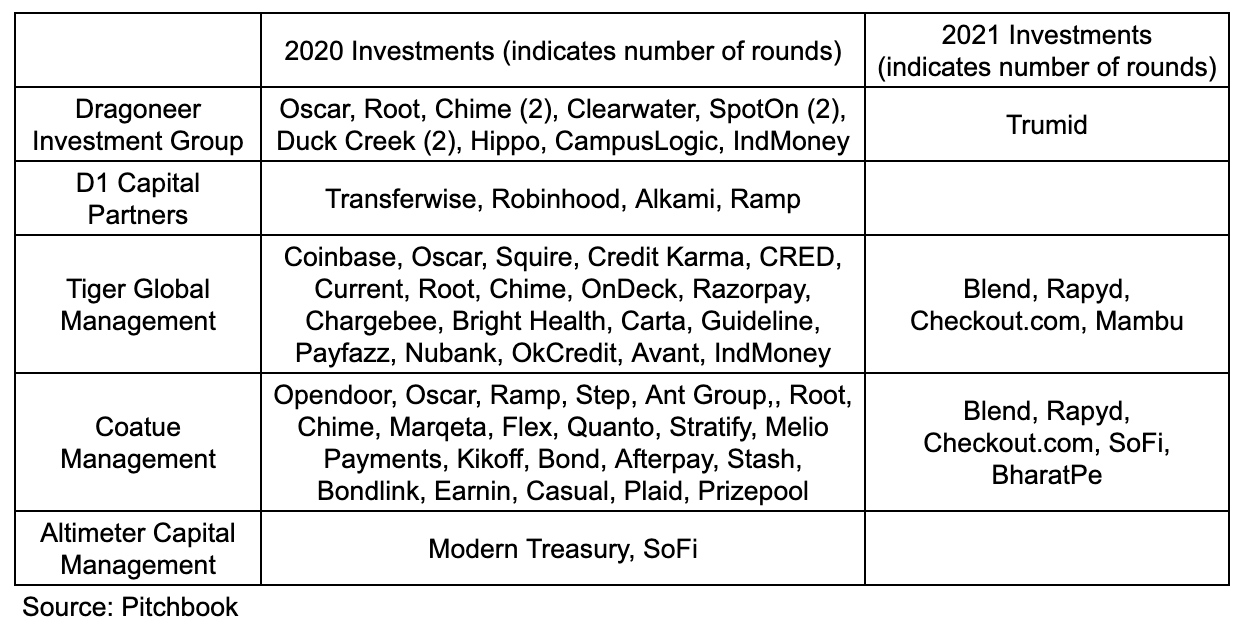

Names like Coatue, Tiger Global, Altimeter, D1 and Dragoneer have started investing later stage rounds in private fintechs recently. The five have invested in 48 rounds in the past 12 months with total deal sizes of $8.7bn. Not all of that investment is from these crossover investors but its still a huge amount in 12months.

With companies staying private longer, low rates for the foreseeable and IPOs popping, I think this trend has some legs but will not be permanent as crossover investors can be fickle. It will have a lasting impact on VCs as firms need to raise larger rounds to keep up and compete with these new investors.

If you are still hanging on to memories of 2020, you are probably alone in that. But luckily Charley Ma has out together the fintech equivalent of Spotify’s Year in 2020.

If you enjoy reading this, please subscribe and share! 🙏

Sponsored Content

Mainstreet finds its startup customers $50,000 each year through furiously searching for tax credits from the government on their behalf. This is money that is specifically designed to help startups, so take advantage! Free money doesn’t come around often and I was always told “Never look a gift horse in the mouth”. Sign up here.

Recent News 📰

🇺🇸 Walmart is partnering with notorious fintech investor Ribbit Capital to launch a fintech startup.

Funding 💸

There were 67 deals in the fintech space across the US and Europe with total investment of $5.1bn. Some highlights are below.

🇪🇺 Subscription management app Minna Technologies has raised €15.5m in a round led by Element Ventures and also featured MiddleGame and Visa.

🇬🇧 Checkout.com raised a $450m Series C led by Tiger Global and included current investors Blossom Capital, Coatue, DST and Insight. Its valuation 3x to $15bn.

🇬🇧 Curve raised £71m in a Series C led by Vulcan Capital with existing investors Fuel Ventures and IDC Ventures participating as the company looks to expand in the US.

🇬🇧 Rapyd announced a $300m Series D led by Coatue Management.

🇺🇸 Modern Treasury announced its $38m Series B led by Altimeter Capital.

🇺🇸 MX announced its $300m Series C led by TPG Growth and included Canapi Ventures and Point72 Ventures.

🇺🇸 Blend announced its $300m Series G, led by Coatue Management and Tiger Global. The round doubles it’s valuation to $3.3bn.

🇺🇸 Business bank Rho has raised a $15m Series A led by M13 Ventures and included Inspired Capital.

🇺🇸 RIA customer experience platform Altruist raised an undisclosed round from Venrock and angel investors.

🇺🇸 Lending Point raised $125m from PE firm Warburg Pincus.

🇺🇸 Affirm went public in an IPO that nearly doubled in price from $49 to $90.

🇺🇸 New credit card startup X1 raised a $12m round led by Spark Capital and included Jared Leto, Aaron Levie and Max Levchin, who probably has some spare cash now.

Embedded Finance

🇺🇸 DriveWealth has bought broker dealer Cuttone and Company, enabling the company to offer direct access to US equities on NYSE, something that was previously only available to institutional investors.

Challenger Banking 🚀

🇪🇺 Czech Republic neobank Octobank is launching with a focus on e-shops and merchants.

🇪🇺 Digital banking infrastructure startup Backbase has been picked by Portugal’s CGD for a digital makeover.

🇬🇧 London based neobank Starling is hunting for lending companies for acquisition as it looks to expand its product offering to drive profitability.

🇺🇸 Think Forward Initiative found 25% of the 1,000 millennials surveyed who use mobile banking apps and use apps to track spend, went overdrawn vs 20% that didn’t use their phone to track spend.

🇺🇸 Consumer lending fintech Upgrade is adding checking accounts and debit cards to its personal loans and credit card offering.

🙌🏻 FATP Take - Upgrade has started with credit and lending before moving to checking accounts and debit cards. It is an interesting sequence to do it as most neobanks start with checking accounts and debit then add lending. Banks make more money in lending so it would make sense to start there but it’s also far harder to get going.

Traditional Banking 🏦

🇺🇸 Goldman Sachs is partnering with Marqeta to power its Marcus checking account, in a boost for the card issuing fintech and its 2021 IPO plans.

🇺🇸 In a conference call with analysts, JP Morgan called upon his management team to “be frightened” about fintechs and lamented some for “unfair competition”.

🙌🏻 FATP Take - Jamie Dimon talking about small fintech’s competing unfairly is quite laughable and really shows the difference in attitudes compared to Goldman Sachs which has been smashing it on the fintech front. JP Morgan also benefits from a whole range of regulatory advantages they benefit from, especially access to Fed funds.

Fintech Infrastructure 🚧

🇺🇸 Plaid and Visa ended their attempted merger this week, disappointing many.

🙌🏻 FATP Take - Many takes say this is positive for Plaid (undervalued) and negative for Visa. Sar Haribhakti has collected some great takes here. I think it’s good for the ecosystem overall as Plaid will be able to continue innovating and develop products quicker by being independent. However it was a deal that validated a lot of other fintech valuations and deals, which has now gone away. Not to mention existing staff are locked up for longer and will likely not leave to create more innovative companies, although some have already left to do that. SPAC expert Chamath may be looking at Plaid if his tweet is anything to go by.

🇺🇸 Equifax is acquiring fraud prevention company Kount for $640m.

Payments 💰

🇪🇺 Ireland’s four largest banks are creating their own multi-bank payment app which will include real-time payments.

🇬🇧 The UK Government voted down a bill designed to regulate BNPL providers, despite support from 70 MPs.

🇺🇸 Ark Invest’s Max Friedrich estimates that Square’s Cash for Business is dramatically increase the gross margin on transactions due to its closed-loop nature.

🇺🇸 Stripe, among others, have blocked payments to the Trump campaign website due to the Presidents role in encouraging the terrorist attack on the US Capitol earlier this month.

🇺🇸 Mastercard is partnering with NMI and Global Payments to trial a cloud version of its Tap on Phone POS technology, helping turn Android phones into POS terminals.

Regulatory Corner 🔎

🇬🇧 Fintech industry body PIF is calling on the UK Government to level the playing field by allowing non-PRA regulated accounts to be eligible for government COVID disbursements.

Longer reads 📜

TikTok and Discord are the new Wall Street Trading Desks - Wall Street Journal

🙌🏻 FATP Take - With everyone having little better to do due to the pandemic, the rise of the retail investor, with apps like Robinhood seeing soaring usage, has disrupted the financial markets. The socialisation of investing has begun as retail investors gather on social media platforms to discuss their trades. Counting for around 20% of volumes, so called “dumb money” by seasoned investors, their influence cannot be ignored and startups will soon be popping up providing alternative data from these social media platforms to hedge funds and other investors. In August Robinhood turned off a feature to allow anyone to see the popularity of stocks on its platform, causing well know third party site Robintrack to shut down. Robintrack will not be the last and it would not be surprising to see Robinhood sell this data to willing buyers in the future. Data in the trading space is golddust. Anything for that edge.

What banks, fintechs can learn from Simple’s rise and sudden death - American Banker

A chat with Josh Schwarzapel, early web entrepreneur & fintech executive - Sarthak Haribhakti

Your feedback is a 🎁, please give below 🙏

Follow me on LinkedIn and Twitter.

Michael