Startups of the Week ⭐🇺🇸🇬🇧🇪🇺🏆

You can check previous Startup of the Week’s here.

🚨FATP is now taking submissions for future Startups of the Week here.🚨

Yotta was founded to improve the financial resiliency of Americans by utilising behavioural psychology techniques to work for them and not against them. Many Americans struggling to save and yet make the confounding decision to buy lottery tickets. This is evidence of a well known psychological phenomenon called present bias which is what powers Yotta’s innovative attempt to get users to save.

Team

Yotta was started in late 2019 by Adam Moelis and Ben Doyle who both have experience in finance and are on the Forbes 30 Under 30 list. Adam previously spent time at Goldman Sachs, Apollo Global and more recently in product at YipitData, a data platform for institutional investors. Ben has a technical finance background from his time at Bridgewater and IMC as well as co-founding Entrypoint, an immersive web experience.

Adam met Ben through a family connection and they share a passion for finance and behavioural psychology. Together they have complementary skills with Adam’s product background and Ben’s technical background.

The Problem

The problem that Yotta is solving is that consumers do not find it easy to save and prefer to spend their money on other things that have more immediate rewards. Whilst this is not a problem for consumers whose higher incomes allow for this, it makes consumers on low incomes financially vulnerable when they are unable to meet unexpected expenses through liquid savings. The data below shows the low amount of savings for those on lower incomes.

These consumers with low savings and low incomes often make the irrational financial decisions of buying lottery tickets which have an extremely low payoff instead of adding to their savings, paying off debt or making more rational financial decisions. The below data shows the lottery spend by income group and whilst the data is somewhat dated, it is likely to still be representative and demonstrate the contradicting decisions to spend money on the lottery when savings are low. Americans spend over $1,000 on average annually on the lottery but survey data from Fool.com shows that 33% of Americans have $1,000 of less in savings and 56% have $5,000 or less.

This problem exists because of a psychological phenomenon called present bias. This bias is the tendency to make decisions to gain a smaller present reward rather than wait for a larger future reward. Savings are a relatively dull affair and come with a reward at some unspecified time in the future when that rainy day you have been saving for finally comes. This contrasts to the more instant gratification of trading stocks or the hope of winning a lottery jackpot, which causes consumers to make irrational financial decisions.

It is amazing that despite this cognitive bias the amount of personal savings is as large as it is. In China the savings rate is around 25%, 3.5x what the pre-pandemic rate was in the US.

With the right gamification the US can become a nation of savers which after seeing the success of premium bonds in other countries, led Adam and Ben to try and tap into this psychological biases but to use it to the advantage of consumers, especially those that are financially vulnerable.

Product

Yotta is a savings account that gives users a recurring ticket into weekly prize draws for every $25 that they save with Yotta. After linking their external bank account, users deposit money into Yotta and they select seven numbers for the weekly draw for each of their tickets on a Monday. Each evening at 9pm ET one number is drawn with the last number drawn on Sunday when the winnings are determined. The weekly prize is up to $10m.

Additionally Yotta pays a “savings reward” of 0.2% on top of any prizes. For legal reasons this cannot be called interest but that is basically what it is. Consumers funds can be withdrawn at any time but are limited to six withdrawals per month. To make the product accessible there are no minimum saving amounts or monthly fees and the money is held in an FDIC insured account with Evolve Bank.

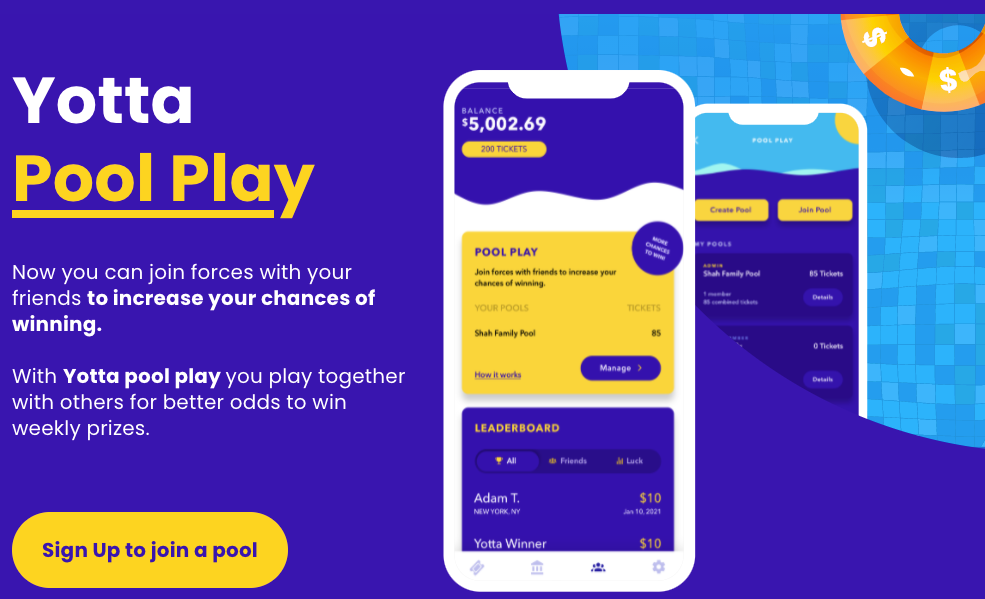

Yotta has recently added Pool Play in an effort to make the product more social and encourage more virality. Pool Play allows friends to pool their tickets and play together for better odds at winning weekly prizes, similar to lottery syndicates. The ability to build a community experience around a product makes it more fun when compared to apps that have spin wheel prizes or scratch cards which are more siloed. With Yotta, there is an anticipation that builds around the draw each night which can be talked about with friends to increase engagement. Remember the buzz around HQ Trivia when it came out a few years ago and had over 2 million people logging on daily to play the game. Yotta is aiming for a similar buzz and excitement with its daily draws. The product has been designed with millennials in mind who typically prefer more social digital experiences.

Also in development but yet to be launched is the Yotta Debit Card which rewards users with one ticket to the draw for every $10 they spend on the card. There will also be the chance to get a random purchase for free as well as a bonus 1,000 tickets if you spend $2,000 in your first four months. Unlike credit cards which offer cashback or reward points whose value is constantly changing, Yotta is keeping it simple with more tickets to its weekly draws which could turbocharge the shift in consumer behaviour from credit to debit. Other companies such as Zero and Petal are also trying to bring credit card-like rewards and features to debit cards alongside Cash App and Venmo with Boost and Rewards respectively.

Market

Yotta is operating at the intersection of two markets, the US lottery market as well as the US savings market. Recent US lottery spend data is not easily available but according to LendEDU there was $72bn spent on the lottery in 2017, with this number likely significantly higher now. Lottery spending is the type of product that might see an increase in spending during tough economic times as people try to get themselves out of economic difficulties by hoping to win a life changing amount at odds of 1 in nearly 300m for the Powerball and Mega Millions.

Whilst a $72bn market is large, it pales in comparison to the US savings market which has experienced rapid growth since the pandemic began. As of 2019, the value of US personal savings was $1.2trn but this nearly doubled to $2.33bn as the savings rate increased from its steady 7% to over 30% in April 2020. With consumers confined to their homes and fears around a recession combined with government stimulus checks, people chose to save.

The personal savings market is a core method through which banks are funded and is the lowest cost of capital for most of them. The average savings rate is currently 0.05% in the US which is much lower than a bank's weighted average cost of capital which can range from 6% to 11%. Banks want to attract deposits because they can loan them out at a higher rate, earning a net interest margin, which was around 3.35% in 2019. Net interest margin, the difference in what banks charge as interest on loans and what it pays out to depositors, is a huge driver of bank profitability, with US banks making around $130bn in net interest income per quarter (source). As Yotta continues to attract some of the $2trn in personal saving deposits, it will look to lend these out and earn itself net interest income and compete further with the banks.

Yotta is based on the concept of premium bonds, which are popular in the UK and Ireland and have previously been used in Scandinavia and New Zealand. Their history in the US has been less clear. As of 2011, premium bonds as a concept were allowed but the winnings were in a legal grey area and may have fallen under gambling laws and so there were no operators of the concept. In 2015 Federal Law was passed which allowed prizes to be won in conjunction with savings accounts if they were FDIC insured and it was for individual states to legalise. Currently two thirds have legalised this concept in different ways but Yotta has taken a different route and is organised as a sweepstake which have similar laws across states making it easier to implement.

The gamification of savings isn’t new but Yotta is taking a different approach of combining regular savings with an aspirationally large jackpot, which has shown to work already with the success of the lottery.

Business Model

Yotta is currently pursuing a B2C business model and is using the hook of gamified savings as its customer acquisition strategy. Yotta passes all interest it earns on its deposits through to its users of its savings product but as it adds additional banking products, these will be monetised through interchange revenue and prize sponsorship. Companies like Chime have built solid businesses based on interchange, interest margin and ATM fees and have paved the way for other fintechs to replicate it with different customer hooks. However the real money in banking is in lending which challenger banks have started to get into with overdrafts and other lending products are sure to follow which Yotta could also roll out in the future as it seeks to put to work its increasing deposits from customers.

Whilst Yotta currently doesn't earn an interest spread as it passes through the rate that it gets from its banking partners to customers, it could be something they look to do in the long run as interest rates increase and it is easier to take a cut of the interest. The company could also serve as an easy way for consumers to get access to market leading interest rates without having to open new accounts themselves if Yotta did this on their behalf. Yotta is protected from someone winning the $10m prize, whose odds is about 1:8,000,000,000, through prize indemnity insurance.

Yotta’s go to market strategy is to play on the virality and social elements of the product by making a high engaged product that users will spread through word of mouth due to its unique features of a high jackpot potential winning combined with a comparatively high effective interest rate of 0.2%. Yotta is building social elements with its Pool Play product and referral codes to increase the incentive for users to refer their friends.

The challenges with Yotta’s business model are threefold.

Building trust

Keeping users engaged

Customer acquisition

Trust

Trust is always difficult to build but is even harder in financial services, and harder still when it comes to savings. People are very risk averse when it comes to savings and they want them to be very safe and often with a bank that is familiar to them. It takes a lot of time to build customer trust but can be destroyed in an instant. Yotta makes it clear on its website who its partner bank is (Evolve) which is a little unusual as it is usually buried deep in terms of service or other obscure places. Whilst Evolve is not a household name, it is the partner to a lot of fintechs and should provide some reassurance to potential customers. The requirement to display that the partner bank is FDIC insured will also help build trust to customers who are aware of what it means and help build trust.

Engagement

Keeping users engaged is a problem for the majority of companies and not specific to Yotta but has been a problem with previous attempts to gamify savings which traditionally sees usage decline after the novelty wears off. Gamification is designed to make saving satisfying by providing a prize or reward when good behaviour, in this case saving, occurs. The pleasure of winning the prize causes the brain to produce dopamine which makes people want to continue playing. The problem with traditional savings is that the reward takes a long time to yield results. Gamification is designed to provide a more instant gratification to encourage more of the desired behaviour so your lump sum of savings grows quicker. Yotta has designed its weekly draw to increase engagement, with one number drawn every night. Its daily active user rate (DAU) is between 60%-65% which is similar to that of Facebook.

The engagement is also where Yotta will face high competition as other fintechs, traditional banks and companies vie for consumers' dollars and attention. Yotta will need to focus on continuing to keep users engaged over time in spite of other competitive products and apps launching.

Customer Acquisition

The challenge of a direct to consumer offering combined with the inertia challenge of financial services makes customer acquisition a significant hurdle. People tend to be lazy with their finances and are less willing to open and close accounts to take advantage of the newer and better offers, preferring to keep it where it is instead of earning a small increase in interest which is likely only to be worth a handful of dollars. Although not an apples to apples comparison, the average US adult has used the same primary checking account for 14 years which gives an indication of likely similar behaviour with savings accounts (source). A similar survey from 2019 by LendingTree found 96m Americans have never switched banks and 47% didn’t know how much interest they are earning on their savings accounts. A similar number thought traditional banks offer the best savings rates and are consequently missing out on $42bn in interest income each year (source)

Companies like HMBradley, Ally, Betterment, Beam etc are all targeting savings accounts and competing with Yotta, giving the consumer a lot of power as to where they put their savings. With VC dollars fuelling these businesses, acquisition costs for fintechs are skyrocketing which puts a focus on the unit economics of these businesses. A predominantly interchange business may struggle to recoup high acquisition costs which means keeping these costs low and growing the product organically or through cheaper methods should be a focus. This is partly why Yotta is making the product more social. One only has to look at Square’s Cash App and its low $5 CAC to see what is possible with the right strategy.

Traction

Yotta has raised almost $18m to date which includes a $13.2m Series A in January 2021 from lead investor Base10 Partners and included new investor Core Innovation Capital as well as follow-on investors Clifford Asness, Ken Moelis, Slow Ventures and Y Combinator.

At the announcement of their series A they had 8m tickets in weekly draws which equates to $200m deposited. With 90,000 users having a deposit in their Yotta account means the average balance is just over $2,000. As mentioned previously, they have good daily active user rates similar to that of Facebook. In terms of defensibility, Yotta is relying heavily on network effects of referring users which makes features like Pool Play more engaging as well as providing more money to make larger prizes. It is also hoping to create high enough switching costs through its debit card and other financial services that will make customers sticky.

Future

Yotta aims to become a complete banking solution for customers and is using its prize-linked savings as its initial hook for customer acquisition. As mentioned previously they are collecting sign ups for their debit card, it would be natural for them to offer a checking account as well as Cash App style sponsored prizes and giveaways. The Cash App Friday’s has proved to be a genius marketing tool to generate a buzz around Cash App through collaborations with celebrities and influencers and is a key driver of their low CAC. Yotta could turn this model on its head with companies sponsoring prizes and giveaways to increase their brand awareness amongst Yotta’s customers.

Until recently, checking accounts and savings accounts were different types of accounts due to restrictions around the number of withdrawals from savings accounts limited. Regulation D limited these transfers to six per month but in April 2020 the Fed announced a change to allow unlimited withdrawals but leaves banks to implement at their own accord. This means that the lines between checking and savings will become blurred and there is no longer a reason to keep these accounts separate. This plays into Yotta’s hands as it could offer one account for checking and savings and capture a larger part of a consumer's liquid assets from both their accounts. An additional feature could also see regular recurring payments be added to a checking account once the debit card product is rolled out so that money isn’t stuck in an account with no way out.

Yotta is focused on building out a B2C business and helping consumers on low incomes make better financial savings by making their psychological biases work with them instead of against them.