FATP (20/01) - Will open banking payments go mainstream?

One of my goals for this year is to write more.

I find writing a great way to synthesise and process my thoughts so I am going to try to post my take on some recent fintech news alongside some recent news highlights every two weeks.

These posts, the first of which is below, are intended to be a stream of conscious thoughts and a conversations starter, not a fully formed and researched opinion.

My aim is for them to spark debate and conversation and I hope my opinions and thoughts are challenged so please reach out.

Will open banking payments go mainstream?

I think quite lot about open banking. It was one of the gateways that first exposed me to the fintech space as it was starting to sweep across Europe. My opinions, like most, have flip flopped on it’s success to date and are generally mix.

I recently collaborated with Stripe’s India Head Manjot Pahwa on a post comparing and contrasting open banking in Europe with India Stack and came away surprised with how limited the remit of open banking was initially but excited for the path ahead and the potential that could be unlocked by learning from other countries.

One of the big things in the open banking space is payments, specifically account-to-account (A2A) payments and I have been thinking about if and how these types of payments might go mainstream in 2022.

As a quick definition, A2A payments mean paying directly from your bank account into a merchants bank account. Whilst ultimately, all payments are account to account at a basic level, A2A payments are direct with no card networks or middlemen involved. It traditionally sits on top of existing payment rails, like Faster Payments in the UK and SEPA in Europe.

I do not want to specifically define mainstream but I would say taking a meaningful (10%+) share of wallet away from other payment methods like cards, is what I consider to be mainstream. Adoption by the mass market and not just early adopters is another metric I would use to determine mainstream.

Will they?

To evaluate if A2A payments will take off, we will take a look at the Jobs To Be Done framework(JBTD) for each of the parties involved in a payment and how A2A might solve them.

Merchant

Merchants have a number of JTBD from a payment perspective, of which I have outlined some main ones below.

Providing customers with their preferred or an acceptable payment method

Reduce cart abandonment

Reduce or eliminate fraud

Minimise cost of transactions

Capture consumer data

Increase average order value

A2A payments are cheaper than most other payment methods such as cards, BNPL and also often cheaper than cash when the costs of cash are correctly accounted for. This is the primary benefit for merchants but minimising costs is not the PRIMARY concern for ALL merchants. For merchants that operate on low margins, reducing costs of processing payments will certainly be high on their list of priorities but for other merchants that have larger margins, they will likely be more concerned with some of the other JTBD, such as customer acquisition and conversion. Additionally, in Europe where the cost of other payment methods, especially cards, is capped and lower than in other western economies, there is less of an impact on cost reduction of A2A.

There are other benefits to A2A payments such as more immediate receipt of funds which helps with cash flow planning and the irrevocability of an A2A payment which are valuable. Currently there is not an established process for refunds within A2A payments and an additional process is needed, which will hamper adoption until it is added.

Payments are so crucial to a business that they are not something that are changed or experimented with lightly and adoption of A2A will likely take longer than expected if it happens at all.

Likely champion 6/10

Consumer

Consumers do not want money to leave their accounts quicker. They do want to receive payments quicker but generally do not want to pay people quicker. Consumers are looking more for the easiest UX and easiest way to pay and this could be an area where A2A can improve things. One of the reasons for the success of BNPL is the ease of having a checkout button to click and a profile with your details already saved. It is a better experience than entering card details.

How A2A will be implemented from a user perspective will be crucial to adoption as anything that adds friction to the process will turn users off. With requirements for increased Strong Customer Authentication to verify payer identity, how each payment method deals with this will be crucial. If the consumer UX flow for paying by card is significantly poorer than for A2A, it could encourage consumer adoption.

Likely champion 5/10

Bank

Seeming banks could be the biggest losers in all of this. Banks, as card issuers, take the largest chunk of interchange revenue to compensate them for the credit risk and costs of servicing customers and would be set to lose this source of revenue if card transactions shift to A2A. Banks could be a pivotal in adding friction to the UX for A2A, making make the UX and services poor. Banks may also see their costs increase as they have to pay to use real-time payment rails like Faster Payments which underly A2A payments on top of losing interchange revenue from cards.

Interestingly, in opposition to the above thoughts, Mastercard and Lloyds Bank Commercial Bank have partnered to enable “PayFrom Bank”, which lets consumers pay directly from their bank accounts on merchant websites. Mentioned in the press release was interest from charities and wallet funding of investment accounts. Both of these use cases make complete sense but are not enough to make A2A mainstream.

Likely champion 3/10

Card Network

Card transaction volume could suffer as a result of more transactions going over A2A rails which would see networks revenues decline. However, Mastercard specifically, through its acquisition of Vocalink in the UK which operates Faster Payments, would see a surge in volumes and resulting volume.

Card networks have also been acquisitive in this space as at attempt to benefit from this shift. Visa is in the process of acquiring Tink, an open banking player which is likely to offer A2A capabilities. Mastercard as mentioned operates the underlying rails in the UK.

Card issuers, i.e. banks, are also one of the biggest customers of card networks and the four party system that they maintain and networks will not want to anger their largest customers in a hurry.

Likely champion 4/10

Who Else is there?

A2A payments could prove a boost to technology companies that are increasingly operating in the financial services industry. Apple and Google are building out their wallet capabilities, they own the devices that consumers have and can use to verify themselves and expanding further into payments is likely, especially if they can get their cut of the pie. By integrating A2A payments into the respective Apple Pay and Google Pay applications would be a game changer and could provide a familiar and frictionless UX.

The other type of company that might benefit from A2A are BNPL companies. Most of the payments that these companies take from customers are repayments are from cards. As such they will likely incur interchange costs and card network fees, something I would think they would be very eager to get remove by using a cheaper rail. The US has recently started to see this with Affirms Debit+ card which decouples the card from a bank account and relies on ACH as the funding mechanism as opposed to traditional card rails and a bank account.

Likely champion 7/10

The How

How might A2A payments enter the customer journey?

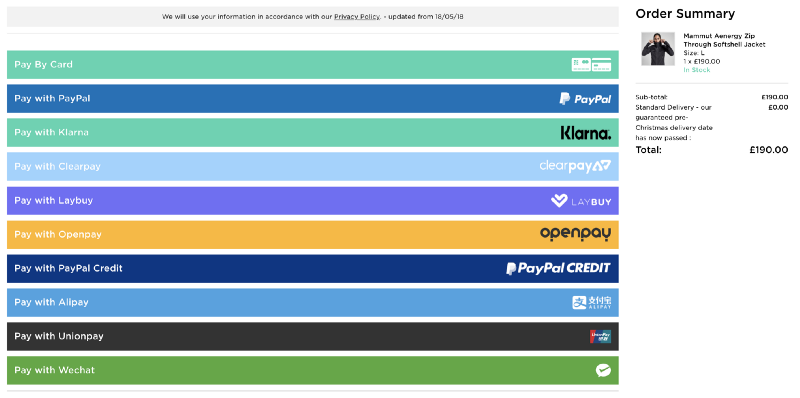

Offline purchases in the e-commerce space should be easier to add an A2A payment option at checkout. Hopefully merchants are careful with their choices and don’t overwhelm the consumer and we don’t get something like the above. A2A could be the underlying rails for new payments solutions which combine other things like loyalty or cashback. I would think we see Stripe, Checkout and Shopify checkout pages with this functionality for merchants to easily integrate with.

In-store is where it proves to be more difficult. The likely UX would have to be on the payment terminal and keeping an eye on any acquisitions and partnerships of modern POS companies may provide insights. With incumbent POS providers with older tech stacks and devices, this is likely harder to implement. I would envisage when a customer inserts or taps their card, the POS could give them an option of paying via debit/credit or A2A from their bank. How else would the consumer be easily able to transmit their account details to the merchant if not through the use of a card?

The one snag to that flow is that the card is issued on the card network rails so would they allow this? Who knows. QR codes would be another way of potentially embedding A2A payments where a merchant produces a QR code for the consumer to scan to take them to a populated payment page on their respective banking app or vice versa. QR codes have seen increased usage given COVID but are still far from pervasive unlike in the Netherlands.

To conclude, given the lack of a real value proposition for the consumer, I don’t believe A2A will take off. Consumers, myself included, do not wish to pay merchants quicker and you can argue the rise of BNPL shows the opposite is true. We also like our credit card reward points. It will take a more sizeable increase in value to change consumer behaviour.

A2A payments are more likely to be continued to be leveraged in B2B payments which are currently still very manual, expensive and time consuming. COVID saw 54% of B2B payments in the UK made by Faster Payments which I would predict will only continue to grow. Combined with some invoicing and tracking tools, it could prove exciting to a finance team.

One of my favourite payments experts Tom Noyes, although US focused, wrote his views on A2A which I mostly agree on. You can read that and more on Tom’s excellent blog.

Fintech News Highlights

🇪🇺 N26 is looking to create 350 jobs in Brazil as it expands its presence and tries to circumvent the customer growth limits it faces in its domestic market. It received a banking license in Brazil a year ago.

🇪🇺 Nordic cross-border payments platform P27 is to replace Denmark’s current national clearing house run by Finance Denmark.

🇬🇧 Revolut has launched as a bank in 10 European countries and now offers deposit protection there.

🇬🇧 Railsbank has built a white label BNPL product for merchants so they do not have to partner with BNPL platforms. It will be available in the UK and Germany in 2022.

🌍 Visa is partnering with ConsenSys to build crypto on-ramps with existing payment rails with the card networks CBDC Payment Module allowing central banks to distribute CBDCs via commercial banks and create CBDC-linked cards.

🌍 US Bank is using TCH’s RTP network’s Request for Payment solution to power is consumer bill pay experience.

Your feedback is a gift, please give below 🙏

Good || Bad || Needs Improving

Follow me on LinkedIn and Twitter.

See you soon!

Very interesting perspective on how the A2A payments could scale given the fact that volt.io have raised $20M in series A funding. Looking forward to how this pans out given the skepticism over the UX.