Tweet of the week 🦉

The above graphic caused a mild storm on Twitter with people saying that fintechs are currently overvalued and is the above is a result of the low interest rate envrionment. Some also pointed out market cap ≠ market share. However, I think it provides an interesting signal and broad picture of the growth of fintechs but best not read TOO much into it.

JP Morgan CEO Jamie Dimon gave the quote “I don’t like outsourcing your heart, your soul, and your spinal cord. I think a lot of companies that ‘outsource’ have no idea what they’re doing.” at Sibos 2020 and provides a biased, but not unfair opinion of the current trend in fintech and banking to outsource and partner.

His second quote of was “I will spend whatever it takes to win in this business. If that means another $2 billion a year then so be it. I really mean that”. That should worry those looking to compete with JP Morgan.

If you enjoy reading this, please subscribe and share with your family, friends and other fintech enthusiasts!

Recent News 📰

🇪🇺 An ING survey into open banking exposed an attitude-behaviour gap with only 30% of respondents on average across Europe being comfortable to share their data if they gave consent. Ipsos found that 75% wanted access to data on how they spend their money but only 40% wanted to provide the information that could lead to that.

🇬🇧 Crowdcube and Seedrs, the secondary market firms, have announced they are merging. Simon Taylor of 11:FS does a great job at summarising the implications here.

Funding 💸

🇬🇧 Monument, a digital bank for the mass affluent has secured a Series A, rumoured to be £10m in size, from existing investors.

🇺🇸 Former JP Morgan exec Eli Polanco has raised $2.5m from Firstmark, Barclays and Anthemis for her ACH payment risk startup, Nivelo. The firm helps manage credit and debit payment risk in real time for companies.

🇺🇸 Mastercard has invested in Marqeta as part of a larger deal in a host of new geographies including APAC. Interestingly Mastercard joins Visa as Marqeta’s investor.

🇺🇸 Bloom Credit, a credit-as-a-service startup, has raised a $13m from new lead investor AllegisNL Capital and includes investors such as Commerce Ventures, Slow Ventures and angels Jake Gibson, Marqeta founder Jason Gardner, Acorns co-founder Jeffrey Cruttenden and Sheel Mohnot.

Embedded Finance

🇺🇸 Macy’s has taken a stake in Klarna which will see the chain offer its customers the possibility to split up online purchases into four interest-free payments. Link.

🇺🇸 In Angela Strange’s 20min VC podcast with Harry Stebbings, she mentioned that gaming could be the first experience children have of financial services. Building on this trend is Razer, which has partnered with Visa for a prepaid card program which comes with an LED light. The Razer Pay app also gives users a personalised experience for rewards.

Challenger Banking 🚀

🇺🇸 Venmo has launched a credit card with its partner Synchrony with benefits including 3% cash back on highest spend category, 2% on second highest and a flat 1% on the remainder. The card is also printed with a unique QR code on it which can be used by friends to scan and send you payments.

🇺🇸 Square’s Capital unit is seeing its head step down. No reason has been given for the departure. In the same week, Square also invested $50m in bitcoin.

🇺🇸 Greenwood, a new digital bank platform for Black and Latinx people has secured $3m in seed funding. Spearheaded by Andrew Young and rapper Killer Mike, the launch puts further pressure on financial services firms to address the racial wealth gap in the US.

🇺🇸 Petal has launched another credit card, this one specifically for people with non-prime credit scores in response to the impacts of Covid. Link.

🇺🇸 Lending Club is shutting its P2P offering to focus on institutional investors.

Traditional Banking 🏦

🇺🇸 BAML is following in the footsteps of Goldman Sachs and launching a financial planning tool to help customers set and track their financial goals.

🙌🏻 Goal based personal financial management is an important mindset shift needed for pfm to expand its usecases. You can read more here.

Fintech Infrastructure 🚧

🇺🇸 USAA has expanded its legal action against banks using technology to deposit checks through their phones to include PNC in Pittsburgh. USAA sued Wells Fargo twice and won $303m in restitution.

Payments 💰

🇪🇺 Italian firm Nexi and SIA are merging to create a €15bn company with a footprint across the entire payments value chain with €1.8bn aggregated revenues. The combined entity will be the largest payments firm in continental Europe by nmber of merchants, cards and transactions.

🇪🇺 The ECB is increasingly looking into cross-currency payments and is investigating the role Target Instant Payment Settlement (Tips) could play in the future.

🇺🇸 37% of US consumers between 18 and 54 have used a BNPL service according to a study, with 39% saying they used it to avoid credit card interest but a worrying 38% to make purchases outside their normal budget. Additionally only 20% fully understood how these plans work.

🇺🇸 Stripe has partnered with Visa to enable buyers on Visa Payables Automation (VPA) to pay suppliers who cannot accept digital payments by utilising a virtual Visa card. Stripe Connect will be plugging into VPA to help migrate to digital payments for the buyer and supplier.

🇺🇸 BNPL giant Affirm has submitted an S-1 indicating it is considering an IPO.

Regulatory Corner 🔎

🇬🇧 Half of UK banks are not confident in their systems ability to identify human trafficking in transactions. This is one of the 22 crimes defined by the EU’s Anti-Money Laundering Directive.

🇺🇸 The OCC has levied a $400m penalty on Citigroup for failing to correct deficiencies in etnerprise-wide risk management, compliance risk management, data governance and internal controls. This is no surpise given the recent leaks of FinCEN and banks attitudes to risk.

Longer reads 📜

Deep Dive Digital Wallets - Michael Jenkins

🙌🏻 Yes this is written by myself but I realised I never linked it in this newsletter so take a look at my perspectives on digital wallets and why they will outlast most digital banks 😄

Users are goal orientated not detail orientated - Michael Jenkins

🙌🏻 Ok yes another one by me on self-driving/automated money combined with personal financial management. This is the last of my self-promoting.

Banking-on-a-headache - Matt Ford, Mouro Capital

🙌🏻 Highly recommend this for people confused about the difference between BaaS, open banking, sponsor banks and platform banking.

Ping-An, the tech company masquerading as a finance company - Simon Taylor

Investing in women isn’t a fucking charity - Jesse Draper

🙌🏻 Hard hitting and powerful piece from Jesse about the $3trn+ opportunity to invest in female founders. Jesse calls on LPs to lead the charge and change their investment philosophy to have a meaningful change on diversity in the venture industry. Cokie Hasiotis of Fintech Today also opined on the misconceptions about female founders.

The biggest transaction of your life - Alex Johnson

🙌🏻 A really great quote from founder Cody Barbo “There are some times that a customer just isn’t a good fit for us and you have to be OK with that too.” A great insight that I think a lot of founders struggle with as they try to acquire every customer and go to great lengths to do so. It can be a distraction.

Life is short - Paul Graham

🙌🏻 Some life lessons from the founder of YC

How to raise £110m in 3 days - James Clark of Draper Esprit

🙌🏻 An interesting insight into the fundraising process for a publicly listed VC firm. The publicly listed VC firm isn’t very common but neither were publicly listed investment banks. Goldman Sachs was a partnership for its first 100 years but by 1998 was the last big private investment bank in the US and IPO’d in 1999. Merrill Lynch went public in 1971, Lehman in 1984 via acquisiton, Bear Stearn in 1985 and Morgan Stanley in 1986. Will we see this model in VC? The investment banks went public between 50 and 100 years into their existence so is overdue for Bessemer and could be happening soon for Greylock, Sequoia, KPB and NEA. a16Z could follow around 2059!

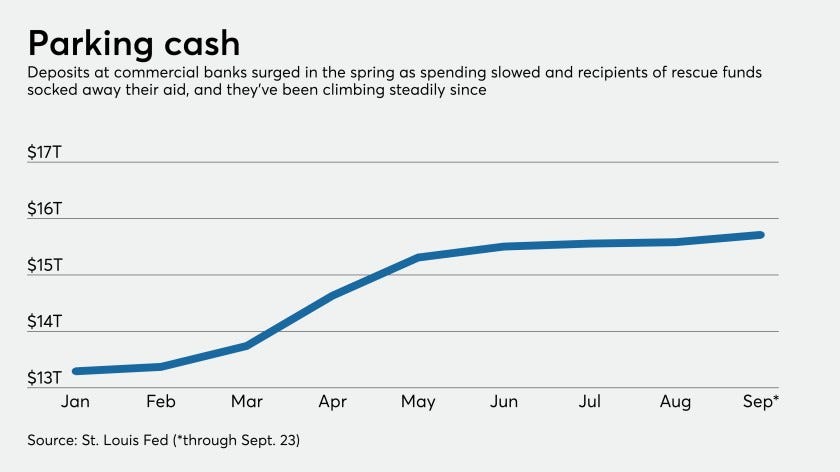

Deposit glub could dog banks well into next year -American Banker

🙌🏻 With the impacts of COVID, people are hoarding cash as the graph above shows. However banks do not want to have this cash on their balance sheets due to worsening of their capital and return metrics as lending opportunities are sparse.

Startups of the Week ⭐🇺🇸🇬🇧🇪🇺

🇺🇸 Bloom Credit, as mentioned above, is a credit data-as-a-service company, that provides access to credit bureau data through an API. It takes a lot of the hassle around formatting and consuming credit data for companies looking to launch lending products. Bloom is based in NYC and was founded by Matt Harris who has been building out the product since 2016 when the company was founded. The team also includes Erin Allard who has experience at Green Dot and The Bankcorp. Bloom has raised $20m to date and most recently a Series A of $13m as mentioned above.

🇺🇸 Max My Interest is a cash management service for investors to maximise the interest they earn from their cash holdings as well as to easily spread the balances between accounts to ensure it is below the FDIC limits. Currently touting 0.85% interest, this is a promising proposition. It was founded by Gary Zimmerman in 2013.

Please get in touch to share your thoughts and comments!

Follow me on LinkedIn and Twitter.

Michael