The future of lending is here.

Well not HERE (in US or Europe) but actually in India 🇮🇳. Check out the long read below on OCEN, the Open Credit Enablement Network. The US and Europe are both getting trounced in fintech by Asian countries.

Tweet of the week 🦉

Entrepreneurs, do not forget to do your own diligence on investors. Diligence is a two way street.

I am always looking out for interesting entrepreneurs and early stage fintechs to feature as Startups of the Week so get in touch if this is you or you know someone working on something interesting in the space!

If you enjoy reading this, please subscribe and share! 🙏

Recent News 📰

🇺🇸 A bunch of fintech acquisitions are facing increased regulatory scrutiny according to WSJ. Visa, Mastercard and Intuit are having their acquisitions of Plaid, Finicity and Credit Karma investigated by regulators.

🙌🏻 FATP Take - A lot of momentum in fintech has come from these deals so any regulatory hold up would put a dampener on the sector. Square is rumoured to be buying Credit Karma’s tax-prep businesses to help move Intuit’s deal through.

Funding 💸

🇪🇺 UBS is investing $200m in fintechs through a new fund and is partnering with Anthemis for support.

🇬🇧 PrimaryBid has raised $50m in a Series B just over a year after its $8.6m Series A. Investors in the round include Fidelity International Strategic Ventures, London Stock Exchange, ABN Amro, Draper Esprit and Outward Venture Capital.

🇬🇧 Icon Solutions has received an undisclosed equity investment from JPMorgan. The startup helps re-engineer payments plumbing to incorporate real-time payment innovations.

🇬🇧 Publicly listed VC firm Augmentum Fintech is looking to raise £28m to increase its investments in fintechs.

🇺🇸 DriveWealth raised $57m in a Series C led by existing investor Point72 Ventures and also adding new investors Mouro Capital and Fidelity International Strategic Ventures.

🇺🇸 Gig Wage has raised a $7.5m Series A from Green Dot to develop banking tools for gig workers. The startup will also use Green Dot’s BaaS platform.

🇺🇸 Alliance Data is buying BNPL firm Bread for $450m. A first big exit in the BNPL sector.

🇺🇸 Jiko has raised a $40m Series A round led by Upfront Ventures and included Nyca Partners.

Embedded Finance

🇺🇸 Wise, the business bank account provider, has raised a $12m Series A to allow partners the ability to offer their customers bank accounts.

Challenger Banking 🚀

🇬🇧 Digital bank Novus is launching a sustainable lifestyle app which tracks the impact of every transaction and will offer a marketplace with ethical and sustainable brands.

🇺🇸 Built Technologies and nCino are partnering to provide a digital construction lending solution. Vertical solutions like this are likely to become more popular.

🇺🇸 In a week that saw SoFi receive preliminary approval from OCC for a national charter, it has also launched a credit card which incentivises users to use cashback to paydown SoFi loans.

🇺🇸 Upgrade, a challenger bank from the former Lending Club chief announced a similar rewards programme.

Traditional Banking 🏦

🇪🇺 Deutsche Kreditbank is rolling out algorithm approved loans from €2,500 up to €30,000 using FinTecSystems technology.

🇺🇸 Goldman Sachs has entered the BaaS space, releasing software that allows developers to build on the back of its cloud system for accounts and payments.

Fintech Infrastructure 🚧

🇺🇸 Astra, the automated money movement service, released APIs for developers to build on.

🙌🏻 FATP Take - Astra is one of the firms at the forefront of self-driving money and the automation of personal finances and is doing incredible work. Read more on the space here.

Payments 💰

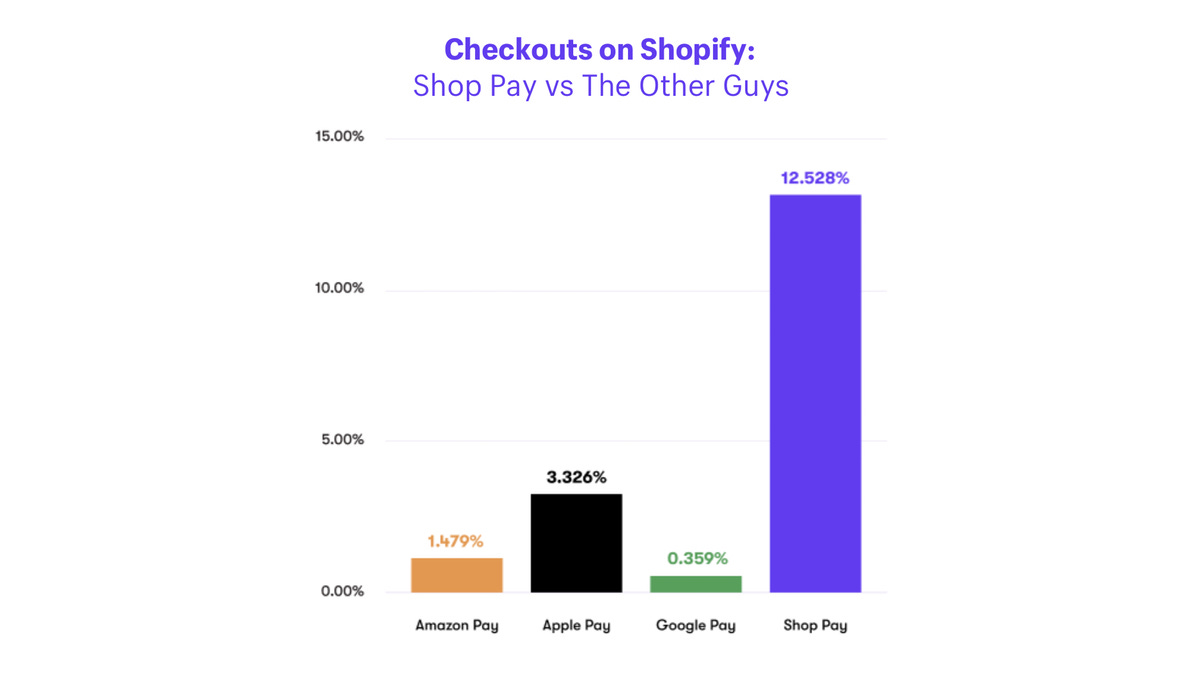

🇺🇸 Shopify is claiming that it completes more checkouts than Amazon, Google and Apple combined (see above).

🇺🇸 Visa reported results which showed debit spend +20% but credit -9%. Visa is also expanding into LATAM by acquiring YellowPepper which provides APIs for access to multiple payment rails through one connection.

Longer reads 📜

OCEN: A Conversation - Rahul Sanghi and Aaryaman Vir

🙌🏻 FATP Take - OCEN is the blueprint for what embedded lending should look like. A set of standard tools and APIs for lenders and loan service providers. The open API approach might work in Europe but I have my doubts about such a standard in the US. A MUST read.

The Mike Speiser incubation playbook - Kevin Kwok

🙌🏻 FATP Take - Excellent read about a less common approach to venture. Highly recommend reading.

How Superhuman Built an Engine to Find Product/Market Fit - Rahul Vohra, Superhuman

Software is eating markets - Packy McCormick

Building the unbuildable - Yusuf Ozdalga, QED

Startups of the Week ⭐🇺🇸🇬🇧🇪🇺

🇺🇸 Stilt is a loan platform for immigrants and others who are underserved by mainstream lenders. These are people that traditional banks won’t lend to because of their lack of credit history, which can turn into a self-perpetuating circle. Stilt uses a combination of traditional credit data as well as supplementing this with information on employment, education and financial behaviour. Lending is one of the products that is most profitable for a bank and by targeting an underserved segment, Stilt is attacking a real problem.

Stilt was founded by Rohit Mittal and Priyank Singh in 2015 and was part of YC’s 2016 Winter batch. Rohit has a heavy background in data and financial modelling as well as writing an awesome newsletter. Priyank is a former Microsoft developer. They have raised $13.5m to date for Stilt.

🇺🇸 FinMkt is a lending platform that provides a white label solution to connect lenders with consumers at the point of sale. It is a multi-lender platform for POS providers, allowing lending to be embedded in their solutions. Lenders get distribution access and POS providers can further monetise its customers.

Embedded lending is the next phase of the embedded finance evolution after payments and accounts. It has the ability to add huge revenue streams for merchants/brands and increase distribution for lenders. The company was founded by Luan Cox and Srikanth Goteti. Srikanth spent 8 years at ICE Data Services, a leader in financial markets data and analytics. Luan is an experienced executive in sales and marketing. FinMkt has raised $12.5m to date.

Your feedback is a 🎁, please give below 🙏

Follow me on LinkedIn and Twitter.

Michael